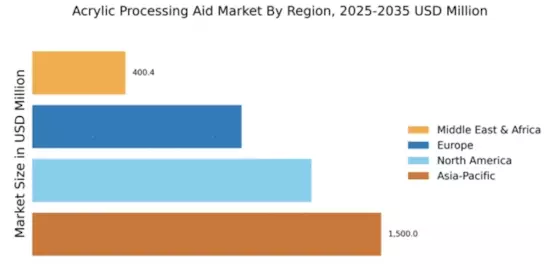

North America : Market Leader in Innovation

North America is poised to maintain its leadership in the Acrylic Processing Aid market, holding a significant share of 1200.0. The region's growth is driven by robust demand from the automotive and construction sectors, alongside stringent regulations promoting sustainable practices. The increasing adoption of advanced manufacturing technologies further fuels market expansion, making it a key player in the global landscape.

The United States stands out as the leading country, hosting major players like Dow Inc. and A. Schulman, Inc. The competitive landscape is characterized by innovation and strategic partnerships among key manufacturers. With a focus on R&D, companies are developing high-performance acrylic processing aids to meet evolving market needs, ensuring North America's continued dominance in this sector.

Europe : Sustainable Growth Focus

Europe's Acrylic Processing Aid market, valued at 900.0, is experiencing growth driven by increasing demand for eco-friendly materials and stringent regulations aimed at reducing environmental impact. The European Union's commitment to sustainability is a significant catalyst, encouraging manufacturers to innovate and adopt greener practices. This regulatory framework is expected to enhance market dynamics and attract investments in the sector.

Germany and France are leading countries in this region, with key players like BASF SE and Evonik Industries AG driving market advancements. The competitive landscape is marked by a strong emphasis on sustainability and technological innovation. Companies are investing in R&D to develop new formulations that align with regulatory standards, positioning Europe as a hub for sustainable acrylic processing aids.

Asia-Pacific : Emerging Market Potential

Asia-Pacific is the largest market for Acrylic Processing Aids, with a valuation of 1500.0, driven by rapid industrialization and urbanization. The region's growth is fueled by increasing demand from the packaging, automotive, and electronics sectors. Additionally, favorable government policies and investments in infrastructure are expected to further boost market dynamics, making it a focal point for manufacturers seeking growth opportunities.

China and Japan are the leading countries in this region, with significant contributions from companies like Mitsubishi Chemical Corporation and LG Chem Ltd. The competitive landscape is characterized by a mix of local and international players, all vying for market share. The presence of key manufacturers and a growing consumer base are driving innovation and product development in the acrylic processing aid sector, ensuring robust growth in the coming years.

Middle East and Africa : Developing Market Landscape

The Middle East and Africa region, with a market size of 400.45, is gradually emerging in the Acrylic Processing Aid sector. The growth is primarily driven by increasing industrial activities and a rising demand for plastics in various applications. Government initiatives aimed at diversifying economies and promoting manufacturing are expected to catalyze market growth, providing opportunities for both local and international players.

Countries like South Africa and the UAE are at the forefront of this development, with a growing presence of key players such as SABIC. The competitive landscape is evolving, with companies focusing on establishing production facilities to meet local demand. As the region continues to develop, the acrylic processing aid market is expected to witness significant growth, driven by both domestic and export opportunities.