Increased Focus on Smart Technologies

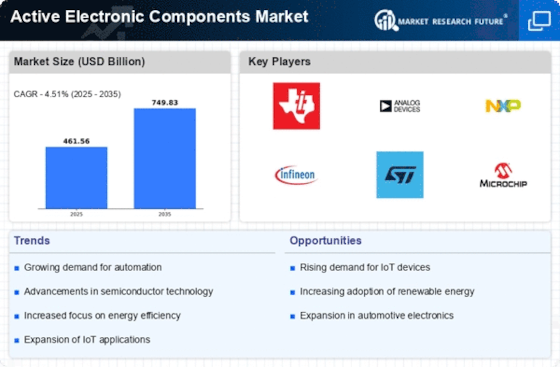

The Active Electronic Components Market is significantly impacted by the increased focus on smart technologies across various sectors. Industries such as healthcare, manufacturing, and agriculture are increasingly adopting smart solutions that rely on active electronic components for automation and data analysis. The smart technology market is expected to grow at a rate of approximately 15% annually through 2025, indicating a robust demand for components that enable these innovations. This trend encourages manufacturers within the Active Electronic Components Market to invest in research and development, aiming to create components that are not only efficient but also capable of supporting the complex functionalities required by smart technologies.

Advancements in Automotive Electronics

The Active Electronic Components Market is witnessing transformative changes due to advancements in automotive electronics. The automotive sector is increasingly integrating sophisticated electronic systems for enhanced safety, efficiency, and connectivity. By 2025, the automotive electronics market is anticipated to exceed 400 billion dollars, with active components playing a crucial role in systems such as advanced driver-assistance systems (ADAS) and electric vehicles (EVs). This shift towards electrification and automation necessitates a robust supply of active electronic components, thereby driving growth within the Active Electronic Components Market. Manufacturers are likely to focus on developing components that meet the stringent requirements of modern vehicles.

Rising Demand for Consumer Electronics

The Active Electronic Components Market is experiencing a surge in demand driven by the increasing consumption of consumer electronics. As households and individuals seek advanced gadgets, the need for components such as transistors, diodes, and integrated circuits has escalated. In 2025, the consumer electronics sector is projected to reach a valuation of approximately 1 trillion dollars, indicating a robust growth trajectory. This demand is further fueled by trends such as smart home devices and wearable technology, which rely heavily on active electronic components. Consequently, manufacturers are compelled to innovate and enhance their production capabilities to meet this growing need, thereby propelling the Active Electronic Components Market forward.

Expansion of Renewable Energy Solutions

The Active Electronic Components Market is significantly influenced by the expansion of renewable energy solutions. As nations strive to reduce carbon emissions and transition to sustainable energy sources, the demand for active components in solar inverters and wind turbines is on the rise. The renewable energy sector is expected to grow at a compound annual growth rate of over 8% through 2025, creating a substantial market for electronic components that facilitate energy conversion and management. This trend not only supports environmental goals but also drives innovation within the Active Electronic Components Market, as companies develop more efficient and reliable components to support these technologies.

Growth of Telecommunications Infrastructure

The Active Electronic Components Market is bolstered by the growth of telecommunications infrastructure. With the ongoing rollout of 5G networks, there is an increasing demand for high-performance electronic components that can support faster data transmission and improved connectivity. The telecommunications sector is projected to invest over 300 billion dollars in infrastructure development by 2025, creating a substantial market for active components such as amplifiers and filters. This investment not only enhances communication capabilities but also stimulates innovation within the Active Electronic Components Market, as companies strive to develop components that can meet the high standards required for next-generation networks.