Enhanced Data Security Measures

Enhanced data security measures are becoming increasingly vital in the Advanced Connectivity in the Oil and Gas Sector Market. With the rise of cyber threats, companies are compelled to invest in robust security solutions to protect sensitive data and maintain operational integrity. The implementation of advanced connectivity solutions often includes integrated cybersecurity features that safeguard against potential breaches. Recent reports suggest that the market for cybersecurity in the oil and gas sector is anticipated to grow significantly, driven by the need for secure data transmission and storage. As firms prioritize the protection of their digital assets, the demand for advanced connectivity solutions that incorporate strong security measures is likely to increase, ensuring the resilience of operations in a challenging environment.

Integration of Smart Technologies

The integration of smart technologies is a pivotal driver in the Advanced Connectivity in the Oil and Gas Sector Market. As companies increasingly adopt smart sensors and devices, they enhance operational efficiency and safety. For instance, the implementation of smart technologies can lead to a reduction in operational costs by up to 20%, as reported by industry analyses. This integration facilitates real-time monitoring and predictive maintenance, which are crucial for minimizing downtime and optimizing resource allocation. Furthermore, the ability to collect and analyze data from various sources allows for improved decision-making processes. Consequently, the demand for advanced connectivity solutions that support these technologies is likely to grow, as firms seek to remain competitive in a rapidly evolving market.

Growing Demand for Remote Operations

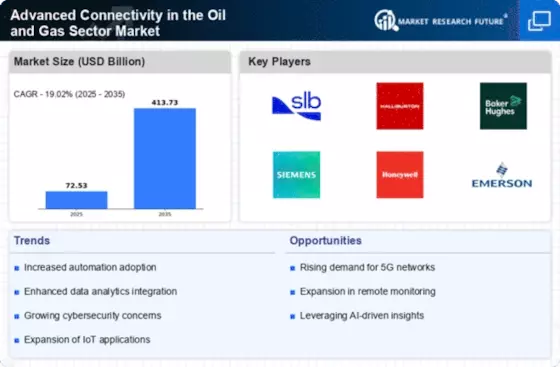

The growing demand for remote operations is a significant driver in the Advanced Connectivity in the Oil and Gas Sector Market. As companies seek to enhance operational efficiency and reduce costs, remote monitoring and control systems are becoming essential. The ability to manage operations from a distance allows for better resource management and quicker response times to potential issues. Recent studies indicate that the market for remote operations technologies is expected to grow at a compound annual growth rate of over 15% in the coming years. This trend is particularly relevant in offshore drilling and exploration, where advanced connectivity solutions enable real-time data transmission and decision-making. As such, the demand for advanced connectivity solutions that support remote operations is likely to increase.

Investment in Digital Transformation

Investment in digital transformation is a crucial driver of the Advanced Connectivity in the Oil and Gas Sector Market. Companies are increasingly recognizing the need to modernize their operations through digital technologies. This transformation often involves the adoption of advanced connectivity solutions that facilitate data sharing and collaboration across various departments. According to recent market analyses, investments in digital technologies within the oil and gas sector are projected to reach several billion dollars by 2027. This shift towards digitalization not only enhances operational efficiency but also improves the overall competitiveness of firms in the market. As organizations continue to prioritize digital transformation, the demand for advanced connectivity solutions is expected to rise correspondingly.

Regulatory Compliance and Safety Standards

Regulatory compliance and safety standards are increasingly influencing the Advanced Connectivity in the Oil and Gas Sector Market. Governments and regulatory bodies are imposing stringent regulations to ensure safety and environmental protection. This has led to a heightened focus on connectivity solutions that can monitor compliance in real-time. For example, the implementation of advanced connectivity systems can help companies adhere to regulations by providing accurate data on emissions and operational practices. The market for compliance-related technologies is projected to expand significantly, as firms invest in systems that not only meet regulatory requirements but also enhance safety protocols. This trend underscores the necessity for advanced connectivity solutions that facilitate compliance and promote sustainable practices.