Market Growth Projections

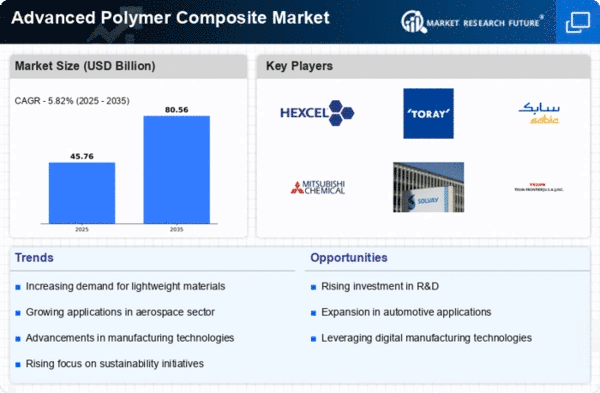

The Global Advanced Polymer Composite Market Industry is projected to experience substantial growth, with estimates indicating a market value of 43.2 USD Billion in 2024 and a potential increase to 80.6 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate of 5.82% from 2025 to 2035, reflecting the increasing adoption of advanced polymer composites across various industries. Factors such as technological advancements, rising environmental concerns, and expanding applications in sectors like aerospace and automotive contribute to this positive outlook, indicating a robust future for the market.

Growing Demand in Aerospace Sector

The Global Advanced Polymer Composite Market Industry experiences a notable surge in demand from the aerospace sector, driven by the need for lightweight materials that enhance fuel efficiency and reduce emissions. Advanced polymer composites are increasingly utilized in aircraft structures, components, and interiors. For instance, Boeing and Airbus have integrated these materials into their latest aircraft models, contributing to a projected market value of 43.2 USD Billion in 2024. This trend is likely to continue as the aerospace industry seeks to meet stringent environmental regulations and improve operational efficiency.

Expanding Applications in Renewable Energy

The Global Advanced Polymer Composite Market Industry is witnessing an expansion in applications within the renewable energy sector. These materials are increasingly utilized in wind turbine blades, solar panels, and energy storage systems due to their lightweight and durable characteristics. For example, advanced polymer composites enhance the efficiency and longevity of wind turbines, contributing to the growth of renewable energy initiatives globally. As the world shifts towards sustainable energy solutions, the demand for advanced polymer composites is expected to rise, further solidifying their role in the renewable energy landscape.

Rising Environmental Concerns and Regulations

Rising environmental concerns and stringent regulations significantly impact the Global Advanced Polymer Composite Market Industry. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting sustainable practices. Advanced polymer composites, known for their lightweight properties and recyclability, align with these environmental goals. Industries are increasingly adopting these materials to comply with regulations and enhance their sustainability profiles. This shift not only supports environmental initiatives but also positions companies favorably in a competitive market, thereby driving the demand for advanced polymer composites across various sectors.

Increasing Adoption in Automotive Applications

The automotive industry significantly influences the Global Advanced Polymer Composite Market Industry, as manufacturers strive to reduce vehicle weight and improve fuel efficiency. Advanced polymer composites are increasingly employed in vehicle components, such as body panels and structural elements. This shift is evidenced by automakers like Tesla and Ford, which utilize these materials to enhance performance and sustainability. As the market evolves, the industry anticipates a compound annual growth rate of 5.82% from 2025 to 2035, potentially reaching a valuation of 80.6 USD Billion by 2035, reflecting the growing emphasis on lightweight materials.

Technological Advancements in Material Science

Technological advancements in material science play a pivotal role in shaping the Global Advanced Polymer Composite Market Industry. Innovations in manufacturing processes, such as 3D printing and advanced molding techniques, enable the production of complex geometries and improved material properties. These advancements facilitate the development of high-performance composites that meet the rigorous demands of various industries, including aerospace and automotive. As companies invest in research and development, the market is poised for growth, with an increasing number of applications emerging across sectors, thereby driving demand for advanced polymer composites.

Leave a Comment