Increased Investment in Aerospace R&D

The aerospace component airborne laser obstacle avoidance monitoring system Market is benefiting from increased investment in aerospace research and development (R&D). Governments and private entities are allocating substantial resources to develop cutting-edge technologies that enhance flight safety and operational efficiency. This influx of funding is likely to accelerate the development of advanced laser obstacle avoidance systems, as companies strive to innovate and maintain competitive advantages. The market could see a rise in collaborations between aerospace manufacturers and technology firms, fostering the creation of next-generation systems. Analysts predict that this trend will contribute to a robust growth trajectory for the market, with R&D investments expected to rise by over 20% in the next few years.

Emerging Markets and Aerospace Expansion

The Aerospace Component airborne laser obstacle avoidance monitoring system Market is also influenced by the expansion of aerospace activities in emerging markets. Countries with growing aviation sectors are increasingly recognizing the importance of advanced safety systems, including laser obstacle avoidance technologies. As these markets develop, there is a rising demand for modern aerospace components that enhance safety and operational capabilities. This trend is likely to drive market growth, as manufacturers seek to establish a presence in these regions. Projections indicate that the market in emerging economies could grow at a rate of 12% annually, reflecting the increasing adoption of advanced technologies in the aerospace sector.

Regulatory Compliance and Safety Standards

The Aerospace Component Airborne Laser Obstacle Avoidance Monitoring System Market is heavily influenced by stringent regulatory compliance and safety standards. Governments and aviation authorities are increasingly mandating the implementation of advanced obstacle avoidance systems to enhance flight safety. This regulatory push is likely to drive demand for laser-based monitoring systems, as they provide a reliable means of ensuring compliance with safety protocols. The market is expected to benefit from these regulations, as manufacturers seek to upgrade their systems to meet evolving standards. Consequently, the market could witness a notable increase in investments aimed at developing compliant technologies, further propelling growth.

Technological Innovations in Laser Systems

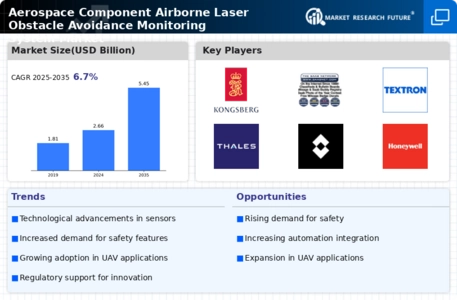

The Aerospace Component Airborne Laser Obstacle Avoidance Monitoring System Market is experiencing a surge in technological innovations, particularly in laser systems. Advancements in laser technology, such as improved range and accuracy, are enhancing the effectiveness of obstacle avoidance systems. These innovations are not only making systems more reliable but also more efficient, potentially reducing operational costs for aerospace manufacturers. The integration of advanced sensors and data processing capabilities is expected to drive market growth, as these features allow for real-time obstacle detection and response. As a result, the market is projected to expand significantly, with estimates suggesting a compound annual growth rate of over 10% in the coming years.

Growing Demand for Unmanned Aerial Vehicles (UAVs)

The Aerospace Component Airborne Laser Obstacle Avoidance Monitoring System Market is poised for growth due to the increasing demand for unmanned aerial vehicles (UAVs). As UAV applications expand across various sectors, including agriculture, surveillance, and logistics, the need for sophisticated obstacle avoidance systems becomes paramount. Laser-based monitoring systems are particularly well-suited for UAVs, as they enhance navigational safety and operational efficiency. Market analysts indicate that the UAV segment is expected to account for a significant share of the overall market, with projections suggesting a growth rate of approximately 15% over the next five years. This trend underscores the importance of integrating advanced laser systems into UAV designs.

.png)