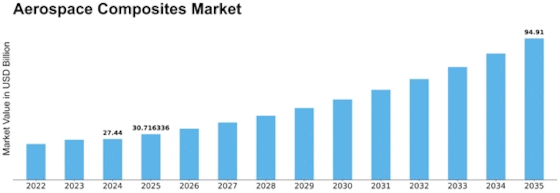

Aerospace Composites Size

Aerospace Composites Market Growth Projections and Opportunities

The market factors envelop the rising interest for lightweight materials, mechanical progressions, administrative guidelines, monetary elements, sustainability concerns, and developing end-client inclinations, aggregately driving the direction of the aerospace composites industry. One critical variable affecting the Aerospace Composites Market is the rising interest for lightweight materials in aircraft producing. As the aerospace business looks to upgrade eco-friendliness, diminish emanations, and further develop execution, there is a developing inclination for lightweight composite materials over customary metallic parts. Composite materials, like carbon fiber, fiberglass, and high-level polymers, offer higher solidarity to-weight proportions, empowering the creation of aircraft parts that are fundamentally lighter without compromising underlying uprightness. This element emphatically impacts market interest, driving the far-reaching reception of aerospace composites. Fluctuations in raw material costs, changes in assembling costs, international pressures, or changes in worldwide interest for air travel impact market patterns and growth possibilities. Financial circumstances, market patterns, and industry-explicit requests influence acquirement choices, influencing the reception and utilization of composite materials in aircraft fabricating. Sustainability concerns and natural contemplations are arising as compelling elements in the Aerospace Composites Market. The aviation business faces expanding strain to diminish its natural impression, provoking makers to investigate eco-accommodating composite materials and creation processes. Drives to create recyclable or bio-obtained composites line up with the business' developing spotlight on sustainability, driving advancement, and affecting market inclinations. Besides, advancing end-client inclinations and changing industry necessities influence the Aerospace Composites Market. The interest for higher-performing, strong, and practical materials from aerospace producers, airlines, and protection project workers shapes market patterns. Changing inclinations for lightweight, high-strength composite materials impact item improvement methodologies, market situating, and the reception of aerospace composites in different applications.

Leave a Comment