Increased Defense Spending

The Aerospace and Defense Metal Stamping Market is poised to benefit from the uptick in defense spending observed in various countries. Governments are allocating larger budgets to modernize their military capabilities, which includes the procurement of advanced aircraft and defense systems. This increase in expenditure is likely to drive demand for precision-engineered metal components, essential for the production of military aircraft and equipment. Recent data indicates that defense budgets in several regions are expected to rise by an average of 3% annually, creating a favorable environment for the Aerospace and Defense Metal Stamping Market. Consequently, manufacturers are focusing on enhancing their production capabilities to cater to this growing demand.

Growing Focus on Sustainability

Sustainability is becoming a pivotal concern within the Aerospace and Defense Metal Stamping Market. Manufacturers are increasingly adopting eco-friendly practices and materials to minimize their environmental impact. This includes the use of recyclable materials and energy-efficient production processes. Regulatory pressures and consumer preferences are driving this shift, as stakeholders demand more sustainable solutions. Reports indicate that companies that prioritize sustainability are likely to gain a competitive edge, as they align with the broader industry trend towards responsible manufacturing. The Aerospace and Defense Metal Stamping Market is thus witnessing a transformation, where sustainability initiatives are not only beneficial for the environment but also for long-term business viability.

Customization and Specialized Solutions

The Aerospace and Defense Metal Stamping Market is characterized by a growing demand for customization and specialized solutions. As aerospace and defense applications become more complex, the need for tailored components that meet specific requirements is increasing. Manufacturers are responding by offering bespoke metal stamping services that cater to unique design specifications and performance criteria. This trend is particularly evident in the production of components for advanced aircraft and defense systems, where precision and reliability are paramount. The ability to provide customized solutions is likely to enhance customer satisfaction and foster long-term partnerships within the Aerospace and Defense Metal Stamping Market, ultimately driving growth and innovation.

Rising Demand for Lightweight Materials

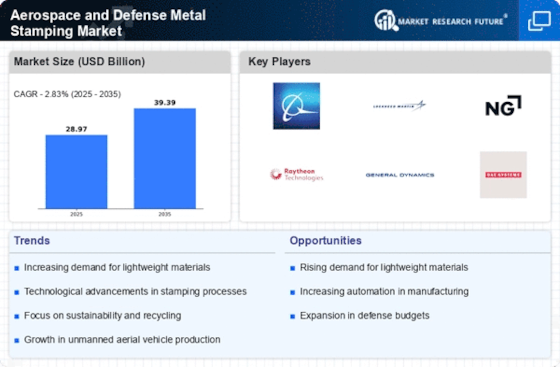

The Aerospace and Defense Metal Stamping Market is experiencing a notable increase in demand for lightweight materials. This trend is primarily driven by the need for fuel efficiency and enhanced performance in aircraft and defense systems. Manufacturers are increasingly utilizing advanced metal stamping techniques to produce components from materials such as aluminum and titanium, which offer superior strength-to-weight ratios. According to industry reports, the aerospace sector is projected to grow at a compound annual growth rate of approximately 4.5% over the next decade, further fueling the demand for lightweight stamped components. As a result, companies in the Aerospace and Defense Metal Stamping Market are investing in innovative technologies to meet these evolving requirements.

Technological Innovations in Manufacturing

Technological innovations are significantly shaping the Aerospace and Defense Metal Stamping Market. The integration of automation, robotics, and advanced manufacturing techniques is enhancing production efficiency and precision. These innovations allow manufacturers to produce complex geometries and intricate designs that meet stringent aerospace and defense specifications. Furthermore, the adoption of Industry 4.0 principles is enabling real-time monitoring and data analytics, which can optimize production processes. As a result, companies are likely to achieve higher quality standards and reduced lead times, positioning themselves competitively within the Aerospace and Defense Metal Stamping Market. This trend suggests a shift towards more sophisticated manufacturing capabilities that align with the industry's evolving demands.