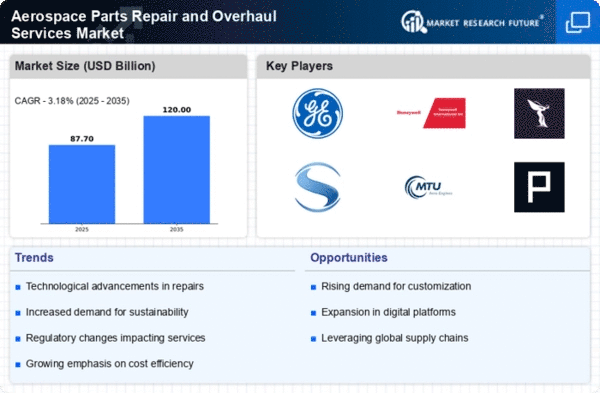

The Aerospace Parts Repair and Overhaul Services Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, increasing air travel demand, and a growing emphasis on sustainability. Major players such as General Electric (US), Rolls-Royce (GB), and Honeywell International (US) are strategically positioning themselves through innovation and partnerships. For instance, General Electric (US) has been focusing on digital transformation initiatives to enhance operational efficiency and reduce turnaround times, thereby improving customer satisfaction. Meanwhile, Rolls-Royce (GB) is investing heavily in sustainable aviation technologies, which not only aligns with The Aerospace Parts Repair and Overhaul Services position in an increasingly eco-conscious industry.The business tactics employed by these companies often include localizing manufacturing and optimizing supply chains to enhance responsiveness to market demands. The competitive structure of the market appears moderately fragmented, with several key players exerting influence over various segments. This fragmentation allows for niche players to thrive, while larger companies leverage their scale to optimize costs and enhance service offerings.

In November Honeywell International (US) announced a strategic partnership with a leading aerospace manufacturer to co-develop advanced repair technologies aimed at reducing maintenance costs and improving service delivery. This collaboration is likely to enhance Honeywell's competitive edge by integrating cutting-edge technologies into its service offerings, thereby attracting a broader customer base. Furthermore, this move underscores the importance of partnerships in driving innovation within the market.

In October Pratt & Whitney (US) unveiled a new facility dedicated to the overhaul of jet engines, which is expected to significantly increase its repair capacity. This expansion not only reflects Pratt & Whitney's commitment to meeting the growing demand for engine maintenance but also positions the company to capitalize on the anticipated increase in air traffic. The establishment of this facility may enhance its operational efficiency and reduce lead times, thereby improving customer satisfaction.

In September Safran (FR) launched a new digital platform designed to streamline the repair and maintenance processes for aircraft components. This initiative is indicative of the broader trend towards digitalization within the industry, as companies seek to leverage technology to enhance service delivery and operational efficiency. By adopting such innovative solutions, Safran is likely to improve its competitive positioning and respond more effectively to customer needs.

As of December the competitive trends within the Aerospace Parts Repair and Overhaul Services Market are increasingly defined by digitalization, sustainability, and the integration of artificial intelligence. Strategic alliances are becoming more prevalent, as companies recognize the need to collaborate in order to drive innovation and enhance service offerings. Looking ahead, it appears that competitive differentiation will increasingly shift from price-based competition to a focus on innovation, technology, and supply chain reliability, as companies strive to meet the evolving demands of the market.