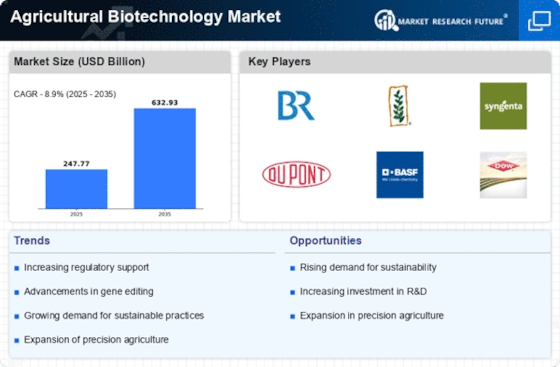

The Agricultural Biotechnology Market is currently characterized by a dynamic competitive landscape, driven by innovation, sustainability, and strategic partnerships. Major players such as Bayer (DE), Corteva Agriscience (US), and Syngenta (CH) are actively shaping the market through their distinct operational focuses. Bayer (DE) emphasizes its commitment to sustainable agriculture, investing heavily in research and development to enhance crop resilience and yield. Corteva Agriscience (US) is strategically positioned as a leader in digital agriculture, leveraging data analytics to optimize farming practices. Syngenta (CH), on the other hand, focuses on expanding its product portfolio through strategic acquisitions and partnerships, thereby enhancing its market presence and technological capabilities. The business tactics employed by these companies reflect a concerted effort to localize manufacturing and optimize supply chains, which are crucial in a moderately fragmented market. This competitive structure allows for a diverse range of products and services, catering to various regional needs. The collective influence of these key players fosters an environment where innovation and efficiency are paramount, ultimately benefiting the agricultural sector as a whole. In August 2025, Bayer (DE) announced a groundbreaking partnership with a leading tech firm to develop AI-driven solutions for precision agriculture. This strategic move is expected to enhance Bayer's capabilities in data-driven farming, allowing farmers to make more informed decisions and improve crop management. The integration of AI into their offerings signifies a shift towards more technologically advanced agricultural practices, aligning with current market trends. In September 2025, Corteva Agriscience (US) launched a new digital platform aimed at providing farmers with real-time insights into crop health and soil conditions. This initiative not only reinforces Corteva's position as a digital agriculture leader but also highlights the growing importance of data analytics in enhancing agricultural productivity. By empowering farmers with actionable information, Corteva is likely to strengthen its customer relationships and drive market growth. In July 2025, Syngenta (CH) completed the acquisition of a biotech startup specializing in gene editing technologies. This acquisition is strategically significant as it allows Syngenta to expand its research capabilities and accelerate the development of innovative crop solutions. By integrating cutting-edge gene editing techniques, Syngenta is poised to enhance its competitive edge in the market, responding to the increasing demand for sustainable agricultural practices. As of October 2025, the Agricultural Biotechnology Market is witnessing a pronounced shift towards digitalization, sustainability, and the integration of advanced technologies such as AI. Strategic alliances among key players are increasingly shaping the competitive landscape, fostering innovation and collaboration. Looking ahead, it appears that competitive differentiation will evolve from traditional price-based strategies to a focus on technological innovation, supply chain reliability, and sustainable practices, ultimately redefining the future of agricultural biotechnology.