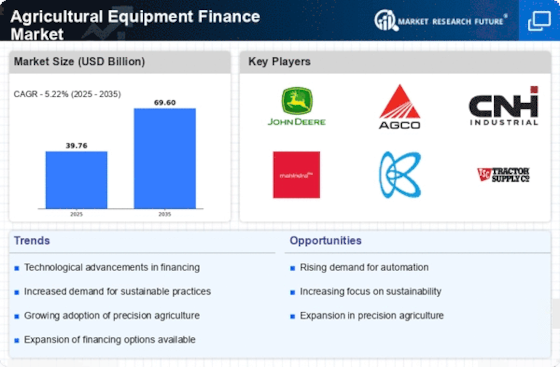

The Agricultural Equipment Finance Market is currently characterized by a dynamic competitive landscape, driven by technological advancements, sustainability initiatives, and evolving consumer demands. Key players such as Deere & Company (US), AGCO Corporation (US), and

CNH Industrial (GB) are strategically positioned to leverage these trends. Deere & Company (US) focuses on innovation through the integration of precision agriculture technologies, enhancing operational efficiency for farmers. Meanwhile, AGCO Corporation (US) emphasizes regional expansion and partnerships, particularly in emerging markets, to capture a broader customer base. CNH Industrial (GB) is actively pursuing digital transformation, aiming to streamline operations and improve customer engagement through advanced financing solutions. Collectively, these strategies not only enhance their competitive positioning but also contribute to a more robust market environment.In terms of business tactics, companies are increasingly localizing manufacturing and optimizing supply chains to respond swiftly to market demands. The Agricultural Equipment Finance Market appears moderately fragmented, with a mix of established players and new entrants. This structure allows for diverse offerings and competitive pricing, although the influence of major companies remains significant in shaping market trends and consumer preferences.

In August Deere & Company (US) announced a strategic partnership with a leading technology firm to develop AI-driven financing solutions tailored for precision agriculture. This move is likely to enhance their service offerings, providing farmers with more accessible financing options that align with their operational needs. The integration of AI into financing processes could streamline decision-making and improve customer satisfaction, positioning Deere as a leader in innovative financing solutions.

In September AGCO Corporation (US) launched a new financing program aimed at small to medium-sized farms, designed to provide flexible payment options and lower interest rates. This initiative reflects AGCO's commitment to supporting the agricultural community, particularly in challenging economic climates. By catering to this segment, AGCO not only strengthens its market presence but also fosters customer loyalty, which is crucial in a competitive landscape.

In July CNH Industrial (GB) unveiled a digital platform that integrates financing options with equipment sales, allowing customers to access tailored financial solutions directly through their purchasing process. This strategic move is indicative of a broader trend towards digitalization in the agricultural sector, enhancing customer experience and operational efficiency. By simplifying the financing process, CNH Industrial positions itself as a forward-thinking player in the market.

As of October the Agricultural Equipment Finance Market is witnessing a shift towards digitalization, sustainability, and AI integration. These trends are reshaping competitive dynamics, with strategic alliances becoming increasingly important for innovation and market penetration. The focus appears to be shifting from traditional price-based competition to differentiation through technology, reliability, and customer-centric solutions. Looking ahead, companies that prioritize innovation and adapt to changing market conditions are likely to emerge as leaders in this evolving landscape.

.png)