Rising Operational Costs

The Agriculture Equipment Finance Market is significantly influenced by the rising operational costs faced by farmers. As input costs for seeds, fertilizers, and labor continue to escalate, many farmers are compelled to seek financing solutions to acquire modern equipment that can help mitigate these expenses. The need for efficient machinery that can perform multiple tasks is becoming increasingly apparent. Consequently, the market for agricultural equipment financing is expected to grow, with estimates indicating a potential increase of 10% in financing applications as farmers look to invest in technology that enhances productivity and reduces long-term costs.

Government Support and Subsidies

Government initiatives play a crucial role in the Agriculture Equipment Finance Market. Various countries are implementing policies that provide financial assistance and subsidies to farmers for purchasing modern agricultural equipment. These programs aim to promote sustainable farming practices and enhance food security. For instance, funding allocated for agricultural modernization has seen a significant increase, with some regions reporting a 20% rise in budgetary support. Such government backing not only alleviates the financial burden on farmers but also stimulates the demand for financing options tailored to agricultural equipment, thereby bolstering the market.

Rising Demand for Advanced Machinery

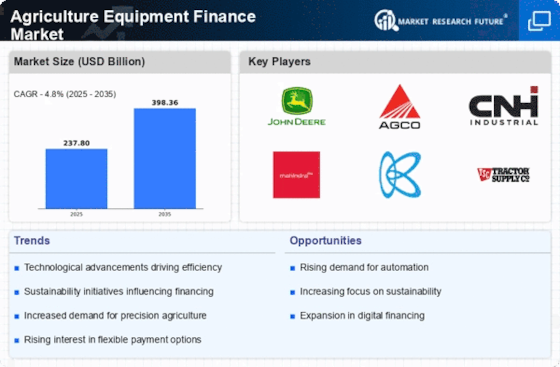

The Agriculture Equipment Finance Market is experiencing a notable increase in demand for advanced machinery. Farmers are increasingly seeking high-tech equipment to enhance productivity and efficiency. This trend is driven by the need for precision agriculture, which utilizes technology to optimize field-level management regarding crop farming. As a result, the market for financing such equipment is expanding, with projections indicating a growth rate of approximately 5% annually. This demand is further fueled by the rising costs of traditional farming methods, prompting farmers to invest in modern solutions that promise better yields and lower operational costs.

Increasing Focus on Sustainable Practices

The Agriculture Equipment Finance Market is witnessing a shift towards sustainable agricultural practices. As environmental concerns grow, farmers are increasingly adopting equipment that minimizes ecological impact. This includes machinery designed for reduced emissions and improved energy efficiency. The market for financing such sustainable equipment is projected to expand, as more farmers recognize the long-term benefits of investing in eco-friendly technologies. Reports suggest that the adoption of sustainable practices could lead to a 15% increase in financing requests for specialized equipment, reflecting a broader trend towards responsible farming.

Technological Advancements in Agriculture

Technological advancements are reshaping the Agriculture Equipment Finance Market. Innovations such as automation, artificial intelligence, and data analytics are becoming integral to modern farming. These technologies not only improve efficiency but also provide farmers with valuable insights into crop management. As a result, there is a growing need for financing options that cater to the acquisition of such advanced equipment. Market analysts predict that the demand for financing related to high-tech agricultural machinery will increase by approximately 8% over the next few years, reflecting the industry's shift towards technology-driven solutions.