Growing demand for food owing to the rising population to boost the market growth

Consumption patterns are changing as a result of the increasing population and wealth around the world. Along with increasing production to meet demand, there is a need to care for the nutritional requirements of an increasingly affluent population. For instance, the IMF estimates that India will have a population of 1.39 billion in 2021. According to FAO, severe food insecurity will affect 11.7% of the world's population in 2021. Waste is caused by shrinking arable land and crops lost to pest attacks, a major obstacle to ensuring food and nutritional security.

The US Department of Agriculture reports that since 2000, the total amount of land used for farming in the US has decreased yearly. As of 2021, there were 895.3 million acres of farmland worldwide, a drop of nearly 50 million. These elements drive up the demand for agrochemicals, increasing agricultural productivity.

Moreover, governments, especially in Asian countries, are taking government initiatives to support farmers by initiating several programs. For instance, the Indian government places a high priority on farmer welfare and is enacting a number of farmer's welfare programs to boost the agricultural sector and enhance farmers' economic circumstances. The government has rolled out several new initiatives like Neem Coated Urea, Soil Health Card Scheme, Paramparagat Krishi Vikas Yojana (PKVY), Pradhan Mantri Fasal Bima Yojana (PMFBY)National Agriculture Market (e-NAM), Pradhan Mantri Krishi Sinchayee Yojana (PMKSY), and Interest Subvention Scheme. All farmers will benefit from these programs.

Further, the Australian government is helping the agriculture sector reach its target of $100 billion in production by 2030. This is another factor driving the growth of the Agrochemicals market revenue.

Additionally, it is anticipated that the expanding animal husbandry and animal feed industries will favorably affect the expansion of the world agrochemicals market. The largest feed industry in the world is found in the United States. The American Feed Industry Association (AFIA) estimates that in 2020, the U.S. exported 32.4 thousand tons of animal feed at a value of USD 13 billion. Thus, this has enhanced the Agrochemicals market CAGR globally.

News :

In April 2024, the Ministry of the Environment granted final approval for the experimental cultivation of a specific type of rice in open fields using advanced genomic techniques called as TEA, or assisted evolution techniques, in Italy. This rice variety possesses inherent resistance to the Pyricularia oryzae fungus, commonly referred to as "brusone" or rice blast fungus. It is capable of withstanding the attacks of this fungal pathogen without the need for fungicides. Rice blast fungus is a highly detrimental disease that can cause significant production losses, sometimes up to 50%, in certain years.

The University of Milan submitted a request for clearance to conduct experiments on plants generated via genome editing or cisgenesis, in accordance with the regulations governing field trials. The laboratory studies utilizing resistance testing have yielded outstanding outcomes in terms of productivity, all without the application of agrochemicals.

In March 2023, the governments of Ecuador, India, Kenya, Laos, Philippines, Uruguay, and Vietnam have collaborated to initiate a $379 million effort aimed at addressing pollution caused by the utilization of pesticides and plastics in agriculture. Chemicals are essential in agriculture, with over 4 billion kg of insecticides and 12 billion kg of agricultural plastics being utilized annually. Although these compounds have advantages in increasing food production, they also provide substantial hazards to human health and the environment.

Up to 11,000 individuals perish each year owing to the poisonous properties of pesticides, and the presence of chemical remnants can harm ecosystems, reducing the fertility of soil and the ability of farmers to adapt to climate change. The incineration of agricultural plastics during their initial disposal further exacerbates a global air pollution emergency, resulting in one out of every nine fatalities worldwide. Toxic persistent organic pollutants (POPs) are released into the environment by very hazardous pesticides and mismanaged agricultural plastics. These chemicals do not degrade and instead contaminate the air, water, and food.

The cost of these inputs is typically lower than that of sustainable alternatives, which provides farmers with minimal motivation to embrace more effective methods.

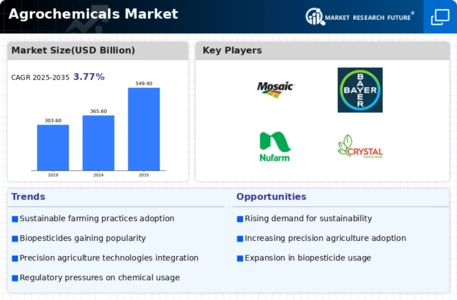

The ongoing evolution in agricultural practices, driven by the need for sustainable food production, appears to be propelling the agrochemicals market towards innovative solutions that enhance crop yield while minimizing environmental impact.

United States Department of Agriculture (USDA)

Leave a Comment