Air Filters Size

Air Filters Market Growth Projections and Opportunities

Searching...

How much is the Air filters market?

The Air Filters Market size was valued at USD 18.88 Billion in 2024.

What is the growth rate of the Air filters market?

The global market is projected to grow at a CAGR of 7.50% during the forecast period, 2025-2034.

Which region held the largest market share in the Air filters market?

Asia pacific had the largest share in the global market

Who are the key players in the Air filters market?

The key players in the market are Daikin Industries, Ltd. (Japan), Camfil (Sweden), MANN+HUMMEL (Germany), Parker Hannifin Corp (U.S.), Cummins, Inc. (U.S.), Donaldson Company, Inc. (U.S.), SPX Flow, Inc. (U.S.), Absolent Group AB (publ) (Sweden), Lydall Gutsche GmbH & Co. Kg (Germany), Purafil, Inc. (U.S.), Freudenberg Filtration Technologies SE & Co. KG (Germany).

Which type led the Air filters market?

The HEPA Filters category dominated the market in 2022.

Which End-User had the largest market share in the Air filters market?

The Commercial had the largest share in the global market.

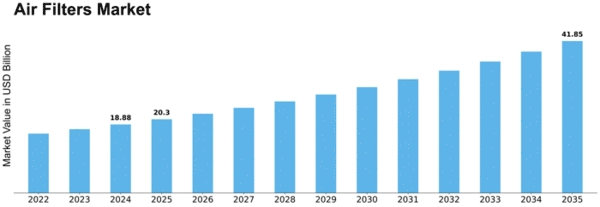

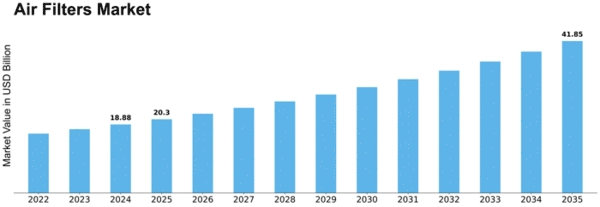

As per MRFR analysis, the Air Filters Market Size was estimated at 18.88 USD Billion in 2024. The Air Filters industry is projected to grow from 20.3 USD Billion in 2025 to 41.85 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 7.5% during the forecast period 2025 - 2035.

The Air Filters Market is experiencing robust growth driven by technological advancements and increasing consumer awareness.

| 2024 Market Size | 18.88 (USD Billion) |

| 2035 Market Size | 41.85 (USD Billion) |

| CAGR (2025 - 2035) | 7.5% |

| Largest Regional Market Share in 2024 | North America |

<a href="https://hbtmkto.honeywell.com/_Portable-Air-Purifiers.html">Honeywell </a>(US), 3M (US), Camfil (SE), Daikin (JP), Mann+Hummel (DE), <a href="https://industrial.filtrationgroup.com/product-segments/industrial-air/">Filtration Group</a> (US), Aaf International (US), Donaldson Company (US), Parker Hannifin (US)

The Air Filters Market is currently experiencing a dynamic evolution, driven by increasing awareness regarding air quality and health implications associated with airborne pollutants. As urbanization continues to rise, the demand for effective air filtration solutions appears to be escalating. This trend is further fueled by regulatory measures aimed at improving indoor air quality in residential, commercial, and industrial settings. Consequently, manufacturers are innovating to develop advanced filtration technologies that cater to diverse applications, enhancing efficiency and performance. Moreover, the integration of smart technologies into air filtration systems is gaining traction, suggesting a shift towards more automated and user-friendly solutions. In addition to technological advancements, the Air Filters Market is witnessing a growing emphasis on sustainability. Consumers and businesses alike are increasingly prioritizing eco-friendly products, which has prompted manufacturers to explore sustainable materials and production processes. This shift not only aligns with global environmental goals but also addresses the rising consumer demand for greener alternatives. As the market continues to evolve, it is likely that these trends will shape the future landscape of air filtration, presenting both challenges and opportunities for stakeholders across the industry.

The Air Filters Market is seeing rapid technological innovations, with manufacturers focusing on enhancing industrial filtration efficiency and effectiveness. New materials and designs are being developed to capture a wider range of pollutants, including fine particulate matter and volatile organic compounds. This trend indicates a commitment to improving air quality across various environments.

There is a noticeable shift towards sustainable practices within the Air Filters Market. Companies are increasingly adopting eco-friendly materials and processes, responding to consumer demand for greener products. This trend not only supports environmental initiatives but also aligns with the growing awareness of health impacts associated with poor air quality.

The incorporation of smart technologies into air filtration systems is becoming more prevalent. These systems offer enhanced monitoring and control features, allowing users to optimize air quality in real-time. This trend suggests a move towards more intelligent and user-centric solutions in the Air Filters Market.

The Air Filters Market is significantly influenced by various application segments, including Residential, Commercial, Industrial, Automotive, and Aerospace. Among these, the Residential segment holds the largest share due to the increasing demand for air quality improvement in homes. The Commercial and Industrial applications also contribute substantially, driven by regulations and the need for clean air in workplaces and manufacturing facilities. However, the Automotive segment is rapidly catching up, driven by advancements in automotive technologies and stricter emission regulations. Growth trends in the Air Filters Market are primarily driven by rising consumer awareness regarding health issues associated with air pollution and the importance of indoor air quality. The Automotive segment, in particular, is experiencing the fastest growth due to the shift towards electric vehicles and the demand for high-efficiency filters. Additionally, government initiatives promoting renewable energy sources also provide a favorable environment for innovation and market expansion in this sector.

Residential (Dominant) vs. Aerospace (Emerging)

The Residential segment in the Air Filters Market stands out as the dominant player, fueled by a growing emphasis on air quality and health consciousness among consumers. This segment is characterized by a wide variety of filter types, including HEPA and activated carbon filters, designed to reduce allergens and pollutants in home environments. The demand for energy-efficient and eco-friendly solutions further bolsters its position. In contrast, the Aerospace segment is emerging as a significant player, reflecting the industry's commitment to ensuring cabin air quality and engine performance. Driven by advancements in filtration technology and increasing safety regulations, this segment is poised for growth as new aircraft models are introduced and existing fleets upgrade their air filtering systems.

The Air Filters Market demonstrates a diverse range of end-use applications, with Air Conditioning holding the largest share due to its ubiquitous presence in residential, commercial, and industrial settings. Heating, Ventilation, and Refrigeration segments follow closely behind, reflecting the critical role of air filtration in maintaining indoor air quality across various environments. Cleanroom applications, while smaller in market share, are rapidly gaining traction driven by advancements in technology and increasing demands for sterile environments in sectors such as pharmaceuticals and biotechnology. As sustainability and energy efficiency become more critical, the demand for advanced air filtration systems is expected to rise. Air Conditioning continues to dominate, yet Cleanroom applications are emerging as a vital growth area, influenced by heightened awareness of airborne contaminants and stringent regulatory standards. The market is also witnessing innovations in filter materials and technologies, propelling growth across all segments, particularly in environments where air purity is paramount.

Ventilation: Heating (Dominant) vs. Refrigeration (Emerging)

In the Air Filters Market, Heating systems are positioned as dominant players, given their established infrastructure and reliance on effective air filtration for safety and comfort. They ensure the efficient operation of HVAC systems, making them critical for maintaining indoor <a href="https://www.marketresearchfuture.com/reports/air-purifier-market-8148">air purifier</a> quality and energy efficiency in both residential and commercial applications. Conversely, the Refrigeration segment is seen as emerging, with growing market opportunities fueled by increased food safety awareness and advancements in refrigeration technologies. The evolving landscape of the Refrigeration market emphasizes the need for specialized air filters that can operate under varying conditions while maintaining efficiency. This shift towards enhanced Refrigeration systems highlights the interconnectedness of air filtration technologies across different end use segments, with advancements catering to both segments to meet the rising expectations for quality and performance.

In the Air Filters Market, the HEPA filters command significant market share due to their superior efficiency in trapping airborne particles, making them the preferred choice in both residential and commercial applications. Activated Carbon filters also contribute favorably to market dynamics, but their share is on the rise as consumers seek solutions for odor removal and chemical absorption, particularly in urban environments. Other types like Electrostatic, Pleated, and Panel filters occupy niche positions, catering to specific needs but lacking the broad appeal of HEPA and Activated Carbon filters.

HEPA (Dominant) vs. Activated Carbon (Emerging)

HEPA filters are distinguished by their ability to capture 99.97% of particles that are 0.3 microns in diameter, making them a staple in healthcare, industrial, and residential settings. Their dominant market position stems from stringent air quality regulations and a growing awareness of indoor air pollution. In contrast, Activated Carbon filters are gaining traction due to their effectiveness in removing odors and volatile organic compounds (VOCs). Their appeal lies in their versatility and efficiency in air purification systems, driving their emergence as a favored choice among consumers looking for cleaner indoor air, particularly in environments with high levels of pollution.

The Air Filters Market exhibits a diversified landscape with various media types influencing its dynamics. Fiberglass filters hold the largest market share, thanks to their cost-effectiveness and reliable performance in trapping airborne particles. Synthetic filters are rapidly gaining traction due to their enhanced filtration efficiency and durability, catering to a growing demand for long-lasting air cleaning solutions. The paper, metal mesh, and foam filters contribute to the market but are less dominant in comparison to fiberglass and synthetic options.

Fiberglass (Dominant) vs. Synthetic (Emerging)

Fiberglass filters are renowned for their affordability and efficiency, making them a staple in residential and commercial air filtration systems. They excel in capturing larger particles, often preferred for general-purpose applications. Conversely, synthetic filters are emerging as a popular choice due to their superior filtration capabilities, often integrating advanced technologies to offer better performance and longer service life. As environmental concerns rise, synthetic filters are increasingly favored for their ability to trap smaller particulates and allergens, appealing to a health-conscious consumer base. This shift in preference is expected to drive the growth of synthetic filters in various applications across the Air Filters Market.

The air filters market exhibits a diverse landscape, with Mechanical filters holding the largest share. These filters dominate due to their widespread use in residential and commercial applications, effectively trapping particulate matter and providing reliable filtration. In contrast, Electrostatic filters are emerging rapidly, attracting attention for their energy efficiency and effectiveness in capturing finer particles, particularly in industrial settings. As awareness of air quality issues grows, both segments are witnessing significant interest from consumers and businesses alike.

Technology: Mechanical (Dominant) vs. Electrostatic (Emerging)

Mechanical filters are characterized by their simple yet effective design, using a physical barrier to capture airborne particles. Their dominance in the air filters market stems from their reliability and low maintenance needs, making them suitable for various environments. Conversely, Electrostatic filters offer a cutting-edge solution with the ability to capture smaller particles through electrically charged elements. Their rising popularity is driven by increasing environmental regulations and a push for cleaner air in indoor spaces. As a result, they represent an emerging segment poised to challenge traditional mechanical filters, particularly in applications where efficiency is critical.

North America is poised to maintain its leadership in the air filters market, holding a significant share of 7.55 in 2024. The region's growth is driven by increasing air quality regulations and a rising awareness of health impacts associated with air pollution. The demand for advanced filtration technologies is also on the rise, spurred by industrial and residential needs for cleaner air. Regulatory bodies are emphasizing stricter standards, further propelling market growth. The competitive landscape in North America is robust, featuring key players such as Honeywell, 3M, and Donaldson Company. These companies are investing heavily in R&D to innovate and enhance product offerings. The presence of established manufacturers and a growing trend towards energy-efficient solutions are expected to sustain market momentum. The U.S. remains the largest contributor, supported by a strong manufacturing base and technological advancements.

Europe's air filters market is projected to grow significantly, with a market size of 5.67 in 2025. The region is characterized by stringent environmental regulations aimed at improving air quality. The European Union's directives on air quality standards are driving demand for high-efficiency air filters across various sectors, including automotive and HVAC. This regulatory push is expected to enhance market growth and innovation in filtration technologies. Leading countries in this market include Germany, France, and the UK, where major players like Camfil and Mann+Hummel are actively engaged. The competitive landscape is marked by a focus on sustainability and energy efficiency, with companies investing in advanced filtration solutions. The presence of established manufacturers and a growing emphasis on indoor air quality are key factors contributing to the region's market dynamics.

The Asia-Pacific air filters market is on a growth trajectory, with a market size of 4.66 in 2025. Rapid urbanization and industrialization in countries like China and India are driving the demand for air filtration solutions. Increasing awareness of air pollution and its health impacts is prompting both consumers and industries to invest in high-quality air filters. Government initiatives aimed at improving air quality are also acting as catalysts for market growth. China and Japan are leading the market, with significant contributions from local manufacturers and global players like Daikin. The competitive landscape is evolving, with companies focusing on innovation and sustainability. The presence of a diverse range of products catering to various applications is enhancing market attractiveness, making Asia-Pacific a key region for future growth in the air filters market.

The Middle East and Africa air filters market is gradually emerging, with a market size of 1.0 in 2025. The region is witnessing a growing awareness of air quality issues, driven by urbanization and industrial activities. Governments are increasingly focusing on environmental regulations, which are expected to boost the demand for air filtration solutions. The need for cleaner air in both residential and commercial sectors is becoming a priority, leading to market growth. Countries like South Africa and the UAE are at the forefront of this market, with local and international players vying for a share. The competitive landscape is characterized by a mix of established companies and new entrants, all aiming to provide innovative air quality solutions. The increasing investment in infrastructure and a focus on health and safety standards are key factors driving market dynamics in this region.

The Air Filters Market is currently characterized by a dynamic competitive landscape, driven by increasing demand for air quality improvement and stringent regulatory standards. Key players such as Honeywell (US), 3M (US), and Camfil (SE) are strategically positioned to leverage innovation and sustainability in their operations. Honeywell (US) focuses on developing advanced filtration technologies, while 3M (US) emphasizes its commitment to sustainability through eco-friendly products. Camfil (SE) is known for its strong emphasis on energy efficiency and air quality solutions, which collectively shape a competitive environment that prioritizes technological advancement and environmental responsibility. In terms of business tactics, companies are increasingly localizing manufacturing to enhance supply chain efficiency and reduce lead times. The market structure appears moderately fragmented, with several key players holding substantial market shares. This fragmentation allows for a diverse range of products and innovations, while the collective influence of major companies drives competition towards higher quality and more efficient air filtration solutions. In November 2025, Honeywell (US) announced the launch of its new line of smart air filters, integrating IoT technology to monitor air quality in real-time. This strategic move not only enhances product functionality but also aligns with the growing trend of digitalization in the industry. By offering smart solutions, Honeywell (US) positions itself as a leader in innovation, potentially attracting a tech-savvy customer base. In October 2025, 3M (US) expanded its manufacturing capabilities in Europe, investing €50 million to increase production of its air filtration products. This expansion is significant as it allows 3M (US) to better serve the European market, responding to the rising demand for high-efficiency particulate air (HEPA) filters. Such investments indicate a strategic focus on regional growth and supply chain optimization, which could enhance their competitive edge. In September 2025, Camfil (SE) entered into a partnership with a leading HVAC company to develop integrated air filtration systems for commercial buildings. This collaboration is indicative of a broader trend towards strategic alliances that enhance product offerings and market reach. By combining expertise, Camfil (SE) aims to deliver comprehensive solutions that address both air quality and energy efficiency, further solidifying its market position. As of December 2025, the competitive trends in the Air Filters Market are increasingly defined by digitalization, sustainability, and the integration of AI technologies. Strategic alliances are becoming more prevalent, allowing companies to pool resources and expertise to innovate more effectively. The shift from price-based competition to a focus on technological advancement and supply chain reliability is evident, suggesting that future differentiation will hinge on the ability to deliver innovative, efficient, and sustainable air filtration solutions.

January 2022: The A.L. Group's innovation arm, AVVIR, a top provider of cutting-edge filtration technologies, announces IN-EX, a medical-grade solution for clean indoor air. The IN-EX solution turns any air filter into a tool for eradicating bacteria and viruses by using specialized sonochemical coating technology.

June 2021: G1 AC Filters for Air Conditioners, made by Nanomatrix Materials, use graphene-silver nanotechnology to sterilize 99.9% of airborne germs and filter out dust particles while purifying indoor air. Additionally, G1 AC Filters help lower harmful volatile organic compounds (VOCs) or gases.

The Air Filters Market is projected to grow at a 7.5% CAGR from 2025 to 2035, driven by increasing air quality regulations, industrial growth, and consumer awareness.

New opportunities lie in:

By 2035, the Air Filters Market is expected to be robust, driven by innovation and strategic partnerships.

| MARKET SIZE 2024 | 18.88(USD Billion) |

| MARKET SIZE 2025 | 20.3(USD Billion) |

| MARKET SIZE 2035 | 41.85(USD Billion) |

| COMPOUND ANNUAL GROWTH RATE (CAGR) | 7.5% (2025 - 2035) |

| REPORT COVERAGE | Revenue Forecast, Competitive Landscape, Growth Factors, and Trends |

| BASE YEAR | 2024 |

| Market Forecast Period | 2025 - 2035 |

| Historical Data | 2019 - 2024 |

| Market Forecast Units | USD Billion |

| Key Companies Profiled | Honeywell (US), 3M (US), Camfil (SE), Daikin (JP), Mann+Hummel (DE), Filtration Group (US), Aaf International (US), Donaldson Company (US), Parker Hannifin (US) |

| Segments Covered | Application, End Use, Filter Type, Media Type, Technology |

| Key Market Opportunities | Integration of smart technology in Air Filters Market enhances efficiency and consumer engagement. |

| Key Market Dynamics | Rising consumer awareness of air quality drives demand for advanced air filtration technologies and sustainable solutions. |

| Countries Covered | North America, Europe, APAC, South America, MEA |

How much is the Air filters market?

The Air Filters Market size was valued at USD 18.88 Billion in 2024.

What is the growth rate of the Air filters market?

The global market is projected to grow at a CAGR of 7.50% during the forecast period, 2025-2034.

Which region held the largest market share in the Air filters market?

Asia pacific had the largest share in the global market

Who are the key players in the Air filters market?

The key players in the market are Daikin Industries, Ltd. (Japan), Camfil (Sweden), MANN+HUMMEL (Germany), Parker Hannifin Corp (U.S.), Cummins, Inc. (U.S.), Donaldson Company, Inc. (U.S.), SPX Flow, Inc. (U.S.), Absolent Group AB (publ) (Sweden), Lydall Gutsche GmbH & Co. Kg (Germany), Purafil, Inc. (U.S.), Freudenberg Filtration Technologies SE & Co. KG (Germany).

Which type led the Air filters market?

The HEPA Filters category dominated the market in 2022.

Which End-User had the largest market share in the Air filters market?

The Commercial had the largest share in the global market.

Kindly complete the form below to receive a free sample of this Report

“This is really good guys. Excellent work on a tight deadline. I will continue to use you going forward and recommend you to others. Nice job”

“Thanks. It’s been a pleasure working with you, please use me as reference with any other Intel employees.”

“Thanks for sending the report it gives us a good global view of the Betaïne market.”

“Thank you, this will be very helpful for OQS.”

“We found the report very insightful! we found your research firm very helpful. I'm sending this email to secure our future business.”

“I am very pleased with how market segments have been defined in a relevant way for my purposes (such as "Portable Freezers & refrigerators" and "last-mile"). In general the report is well structured. Thanks very much for your efforts.”

“I have been reading the first document or the study, ,the Global HVAC and FP market report 2021 till 2026. Must say, good info! I have not gone in depth at all parts, but got a good indication of the data inside!”

“We got the report in time, we really thank you for your support in this process. I also thank to all of your team as they did a great job.”

Leave a Comment