Market Share

Aircraft Computers Market Share Analysis

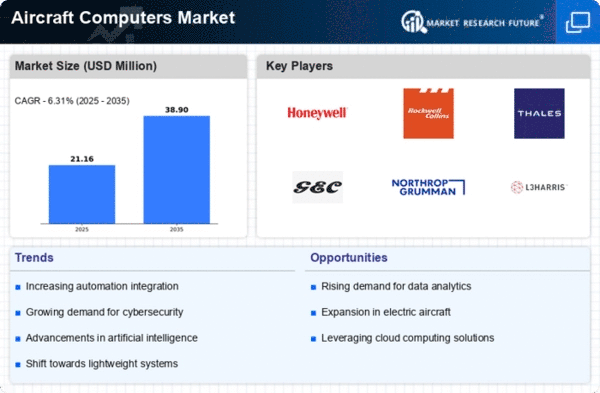

The market for Aircraft Computers is a constituent part of modern aviation technology, which has grown considerably as aircraft have become more dependent on sophisticated computer systems. In this competitive scenario, companies are adopting various market share positioning strategies to establish their presence in the industry. Differentiation is one of the key strategies, where companies invest in developing highly intelligent aircraft computers that come with powerful processing capabilities, high dependability and compatibility with new technologies. This is meant to target airplane manufacturers and operators looking for top notch computing abilities in navigation, communication and avionics.

Another significant strategy applied by businesses operating in the Aircraft Computers sector is cost leadership. Some firms focus on cost effective manufacturing and efficient supply chain management to offer computing systems at competitive prices without compromising quality. It is important to note that this approach holds a lot of weight especially when it comes to the aviation industry where price factors play a major role. By minimizing production costs incurred by these firms, they can position themselves as cheap and reliable providers of goods thereby appealing to numerous jet makers as well as pilots who fly them.

Collaboration and partnership are vital aspects affecting market positioning within the Aircraft Computers segment. Strategic alliances are often built between companies such as avionics integrators, airplane manufacturers or even tech providers. These collaborations help in developing integrated computing solutions that seamlessly interface with other avionics systems available in planes’ cockpits.Communication among such organizations also facilitates better understanding of changing needs and regulations within the airline industry leading to generation of solutions that meets particular requirements for each type of plane platform.

Market penetration is one strategy used by businesses whose aim is expanding its presence/territory/penetration into new markets within the Aircraft Computers Industry (ACI). This implies entry into new markets or increasing adoption rates amongst existing ones. The growth being experienced globally in the aerospace industries prompts many companies into purposely targeting emerging markets where demands for advanced avionics and information processing units increase significantly over time. Successful penetration of new markets is only conceivable when one has an in-depth understanding of regional aviation regulations, the most common types of aircraft and how different aspects of aviation influence each other.

Customer-centric strategies are crucial in the Aircraft Computers market. Companies give priority to customers’ wants through provision of technical support system, training programs and easy to use user interfaces. Strong relationships with jet manufacturers as well as pilots build trust and loyalty hence repeat business that emanates from word-of-mouth references. Having an insight into the importance that information technology plays in the operation of airplanes is vital for tailoring solutions that meet individual client needs.

Innovation continues to shape the Aircraft Computers market as companies invest more in research and development (R&D) to stay ahead with respect to emerging technologies. Continuous innovations result into development of small sized, energy efficient and high performance computing systems meeting stringent requirements posed by aviation operational environment.These features not only attract customers who want state-of-the-art products but also make them leaders when it comes to providing dependable computing technology for all sorts of aircraft.

The Aircraft Computers industry which is considered a fundamental part of modern-day aviation technology has witnessed significant growth due to increased reliance on advanced computer systems by airplanes. Within this competitive environment, there are various strategies used by companies in their efforts to position themselves competitively in this sector. One key strategy among others involves differentiation where companies focus on developing sophisticated aircraft computers which possess higher processing capability, dependability and compatibility with other evolving technologies. This attracts airplane manufacturers that need navigational, communication or avionics systems with up-to-date computing capabilities.

Another core strategic approach used in the Aircraft Computers market is cost leadership.Thus, some firms concentrate their attention on cost-effective production techniques as well as enhanced supply chain management which enable them provide computers at reasonable prices without compromising quality.The significance lies in the fact that it is highly applicable in the air transport industry whereby pricing factors come into play.By minimizing production costs, these firms can be seen as cheap and reliable suppliers of products thereby appealing to a wide spectrum of airplane manufacturers and operators.

Collaboration, partnerships have been known as the major ways of positioning one self in the market within the Aircraft Computers sector. In order to achieve this, many companies often enter into strategic alliances with avionics integrators (vendors), OEMs (aircraft manufacturers) or even other software providers. These relationships can help create software solutions that speak with avionics system on board seamlessly.Through this type of communication companies are better able to understand changing needs and regulations in Aviation, thus helping to come up with products for various aircraft platforms.

Market penetration is a strategy which entails expanding its penetration within the Aircraft Computers Industry through entering new markets or increasing adoption rates amongst existing ones. This means entering new markets or increasing their presence in existing ones. The aviation industry has seen tremendous growth across the globe therefore it makes sense for businesses to target emerging markets and regions experiencing rising demand for modern avionics and similar computing systems at airports.Such an approach requires having deep knowledge about regional laws governing air transportation sectors, prevalence of certain types of planes as well as unique challenges faced by diverse sectors within aviation.

In the Aircraft Computers market, customer centricity is essential. Thus, firms offer complete technical support services, training programs along with easy-to-use interfaces.A strong bond between plane and pilots’ manufacturers leads to trust as well as loyalty that is followed by repetitive sales due word-of-mouth recommendations.” Understanding how vital computers are in running airlines would be useful when designing IT packages tailored for different customers.

Innovation remains a driving force in the Aircraft Computers market with companies investing a lot on research and development just to remain ahead in terms of the latest technologies.Every time there [sic] changes going on that bring forth compactness, energy saving ability and high-speed functions requirements associated with an aircraft’s computer system. These changes not only appeal to the customers who want the latest technology but also make them market leaders in provision of reliable and advanced computing technology for different aircraft platforms.

Leave a Comment