Market Trends

Key Emerging Trends in the Aircraft Computers Market

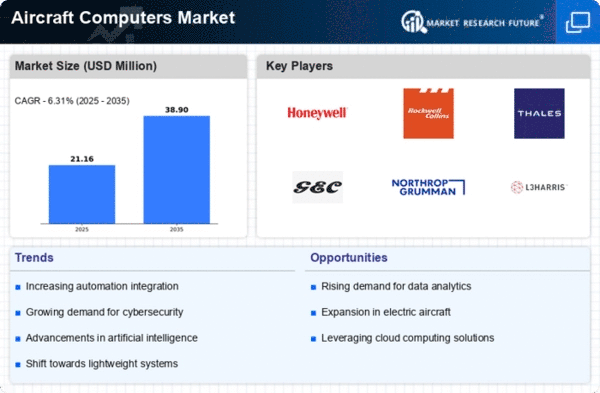

The Aircraft Computers market is undergoing considerable changes that indicate the ever-changing technology in aviation. The sector of Aircraft Computers has experienced several trends over the years, which have changed its face. One of the major driving forces is the need to have modern aircraft with advanced avionic systems and computational capabilities. The industry’s movement toward more autonomous and connected systems necessitates that aircraft computers are powerful and reliable for flight management, navigation, communication and overall mission effectiveness.

Market dynamics of Aircraft Computers are defined by technological advancements in this sector. Computing power in aircraft systems has tremendously increased with the incorporation of high-performance processors, sophisticated GPUs (graphics processing units) as well as robust memory systems. Consequently, these developments make it possible for complex tasks such as real-time data processing, sensor fusion and decision-making algorithms to be carried out smoothly thereby leading to safer and efficient flight operations.

Additionally, open architecture standards adoption in aviation computerization trend is increasingly becoming prominent. Through open architecture standards allow easier upgrades and modifications because different avionics systems can easily interoperate hence enhances flexibility. This approach enables airplane operators to remain up-to-date with current technologies; meet changing regulatory requirements; incorporate new features without overhauling entire system.

Moreover Artificial Intelligence (AI) applications involving Machine Learning (ML) within aviation are among significant trends occurring in Aircraft Computers market today.AI powered algorithms optimize flight operations,predict maintenance needs for equipment,and improve efficiency of whole systems.Furthermore,data driven decision making growing popular among airlines implies that integration AI technologies into aircraft computers will continue reshaping how planes operate and adapt themselves according to varying conditions.

Furthermore,the rising demand for connectivity coupled with technological advancements is impacting on market dynamics. Nowadays there is a larger number of interrelated processes within an airplane that depend on data transfers so much so that more they concern about better communication inside flights.Aircraft computers play an essential role in ensuring connections occur seamlessly during flights including support such as inflight entertainment, passenger connectivity and real time communication with ground based systems.

Market trends in the Aircraft Computers sector are also driven by global collaborations and partnerships. Leading industry players are forming strategic alliances with technology providers, research institutions, and regulatory bodies to drive innovation and address industry-wide challenges. They aim at standardizing solutions, sharing expertise and speeding up development of state-of-the-art aircraft computing technologies through such collaborations.

However, there are some challenges in the Aircraft Computers market including cyber security risks associated with increasing connectedness and reliance on digital technologies. With expanding interconnection among aircraft systems, ensuring data security as well as its integrity is crucial for protection against any possible cyber threats.”

Leave a Comment