Increased Air Traffic Demand

The Airspace and Procedure Design Market is experiencing a notable surge in air traffic demand, driven by the expansion of commercial aviation and the rise of low-cost carriers. According to recent data, air traffic is projected to grow at an annual rate of approximately 4.5% over the next decade. This increase necessitates the development of more efficient airspace designs and procedures to accommodate the growing number of flights while ensuring safety and minimizing delays. As a result, stakeholders in the Airspace and Procedure Design Market are compelled to innovate and enhance their offerings to meet the evolving needs of airlines and regulatory bodies.

Collaboration Among Stakeholders

Collaboration among various stakeholders, including airlines, air navigation service providers, and regulatory authorities, is a pivotal driver in the Airspace and Procedure Design Market. This collaborative approach fosters the sharing of best practices and innovative solutions, ultimately leading to enhanced airspace efficiency and safety. Joint initiatives, such as the development of standardized procedures and technologies, are becoming increasingly common. For example, partnerships between technology firms and aviation authorities have led to the creation of advanced air traffic management systems. Such collaborations not only streamline operations but also contribute to the overall growth and resilience of the Airspace and Procedure Design Market.

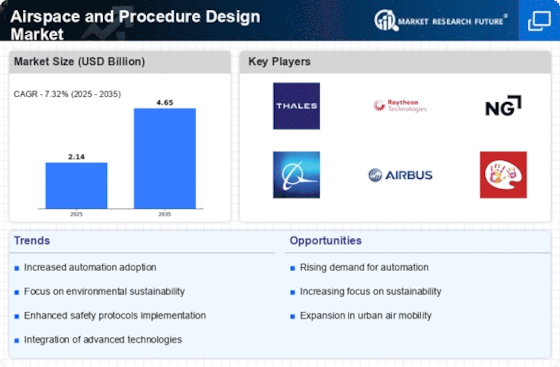

Integration of Advanced Technologies

The integration of advanced technologies, such as artificial intelligence and machine learning, is transforming the Airspace and Procedure Design Market. These technologies enable more precise modeling and simulation of air traffic scenarios, leading to optimized airspace designs and improved operational efficiency. For instance, AI-driven tools can analyze vast amounts of data to predict traffic patterns and suggest modifications to existing procedures. This technological evolution not only enhances safety but also contributes to cost savings for airlines and air navigation service providers. The ongoing investment in these technologies indicates a robust growth trajectory for the Airspace and Procedure Design Market.

Focus on Environmental Sustainability

Environmental sustainability has emerged as a critical driver in the Airspace and Procedure Design Market. With increasing awareness of climate change and its impacts, stakeholders are prioritizing the development of eco-friendly airspace designs and procedures. Initiatives aimed at reducing carbon emissions and noise pollution are gaining traction, prompting the adoption of more efficient flight paths and procedures. For example, the implementation of Continuous Descent Approaches (CDA) has been shown to reduce fuel consumption and emissions significantly. This focus on sustainability not only aligns with regulatory requirements but also enhances the reputation of airlines and service providers within the Airspace and Procedure Design Market.

Regulatory Compliance and Safety Standards

The Airspace and Procedure Design Market is heavily influenced by the need for compliance with stringent regulatory frameworks and safety standards. Regulatory bodies continuously update guidelines to enhance safety and operational efficiency in air traffic management. This necessitates ongoing adjustments and improvements in airspace designs and procedures to align with these evolving regulations. For instance, the introduction of Performance-Based Navigation (PBN) procedures has been a response to regulatory demands for more efficient use of airspace. As a result, companies within the Airspace and Procedure Design Market must remain agile and responsive to these regulatory changes to maintain their competitive edge.