Alcoholic Beverages Size

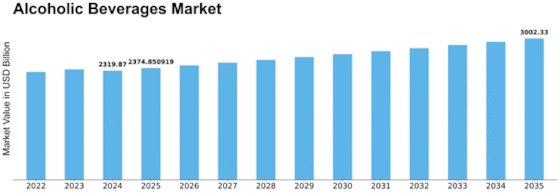

Alcoholic Beverages Market Growth Projections and Opportunities

The market for alcoholic beverages suffers from a plethora of factors that affect its marketing dynamics and advancement. Consumer tastes are becoming higher and more people want to try premium or artisanal cocktails. Consumers have become more discerning and started seeking unique high class drinking experiences. This has contributed to a significant trend towards artisanal speciality alcoholic products. In the alcoholic beverages sector, crafted beer stalls are gaining popularity as people look for authenticity to get an extraordinary taste. The major driving factor for the macro environment in which alcoholic beverage industry operates is economic conditions. The demand for alcoholic beverages is also influenced by consumer spending patterns, disposable income levels and the economic conditions. The slump in the economy may result to consumers altering their approach towards purchases thereby purchasing cheaper brands or even trade down as valued by lower cost alternatives. In contrast, during periods of economic boom people may be more inclined to spend money on the costlier and luxury drinks thus universal market conditions. Alcoholic beverages market largely depends on the regulatory environment. All governments also enforce very strict limits on the distribution and sale of alcoholic beverages to ensure public safety as well industry control. License requirements, advertisement limitations and legal drinking age are among the factors determining market practices. These regulations are applicable to the manufacturers and distributers of alcoholic beverages that would need to follow them for ensuring legality on an aspect of integrity within its market. Cultural and social issues are the key factors influencing consumer preferences in Alcoholic Beverages Market. Drinking habits, traditions and cultural norms vary greatly place to people. For instance, cultural preferences affect their choices of certain types of drinks like sake in Japan or whiskey from Scotland. Moreover, social changes like the awareness of mindful drinking and emphasis on healthy lifestyles grant popularity to low-alcohol- or alcohol-free alternatives; this helps make the market more diverse. Technological advancements and innovation in the production methods have been responsible for Market of Alcoholic Beverages evolution. The introduction of new brewing techniques, distillation processes and fermentation procedures allow producers to produce alcoholic beverages with unique characteristics. This innovation has never stopped on the boundaries of beer, wine and spirits but opened creation as entirely new product categories such as hard seltzers or flavored alcoholic beverages.

Leave a Comment