Growing Health Consciousness

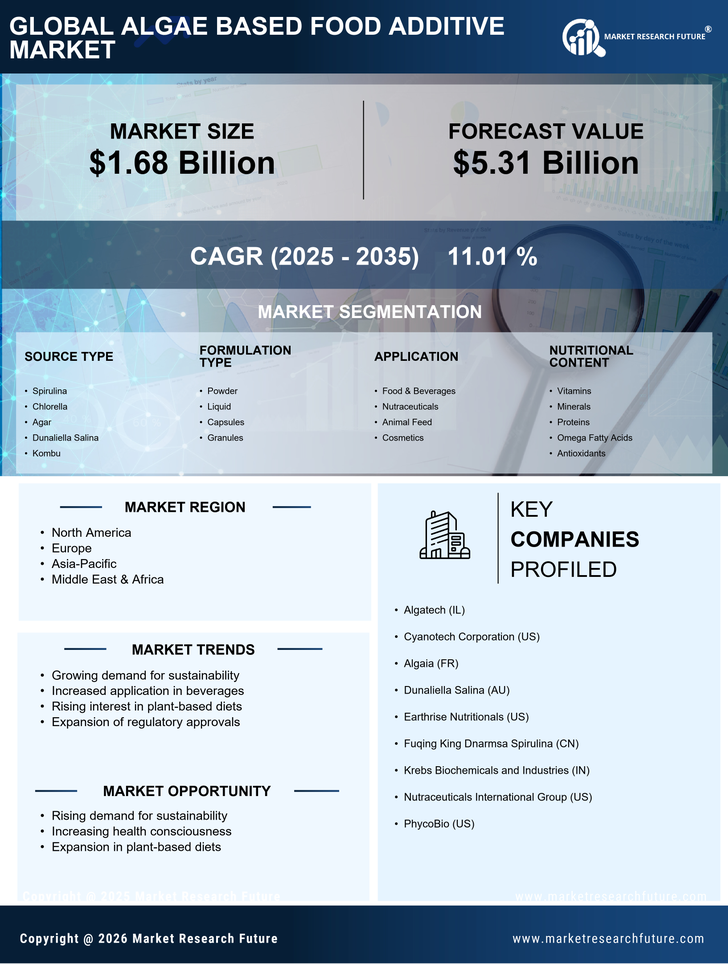

The Algae Based Food Additive Market is experiencing a surge in demand driven by an increasing awareness of health and wellness among consumers. As individuals become more health-conscious, they seek food products that offer nutritional benefits without artificial additives. Algae, rich in vitamins, minerals, and antioxidants, presents a compelling alternative. Market data indicates that the demand for natural food additives is projected to grow at a compound annual growth rate of 7.5% over the next five years. This trend suggests that consumers are gravitating towards products that not only enhance flavor but also contribute positively to their health, thereby propelling the algae-based segment forward.

Versatility in Food Applications

The Algae Based Food Additive Market benefits from the versatility of algae in various food applications. Algae can be utilized in a wide range of products, including snacks, beverages, and dietary supplements, catering to diverse consumer preferences. This adaptability allows manufacturers to innovate and create new products that meet the evolving demands of the market. For instance, the incorporation of algae in protein bars and smoothies is gaining traction, appealing to health-oriented consumers. Market analysis suggests that the segment for algae-based protein additives could witness a growth rate of approximately 8% annually, reflecting the increasing acceptance of algae in mainstream food products.

Innovative Research and Development

The Algae Based Food Additive Market is significantly influenced by ongoing research and development efforts. Innovations in algae cultivation techniques and extraction methods are enhancing the quality and efficiency of algae-based products. Research institutions and companies are collaborating to explore new strains of algae that offer superior nutritional profiles and functional properties. This focus on R&D is likely to lead to the introduction of novel algae-based additives that can cater to specific dietary needs, such as gluten-free or high-protein options. As a result, the market could see a substantial increase in product offerings, potentially driving growth rates of 9% or more in the next few years.

Rising Interest in Plant-Based Diets

The Algae Based Food Additive Market is poised for growth due to the rising interest in plant-based diets. As more consumers adopt vegetarian and vegan lifestyles, the demand for plant-derived food additives is escalating. Algae, being a plant-based source of nutrients, aligns perfectly with this dietary shift. The market for plant-based food products is expected to reach USD 74 billion by 2027, indicating a robust opportunity for algae-based additives. This trend not only supports the health benefits associated with plant-based eating but also addresses ethical concerns regarding animal welfare, further enhancing the appeal of algae in the food industry.

Sustainability and Environmental Concerns

The Algae Based Food Additive Market is increasingly influenced by sustainability and environmental considerations. As consumers and manufacturers alike become more aware of the ecological impact of food production, algae emerges as a sustainable alternative. Algae cultivation requires significantly less land and water compared to traditional crops, making it an attractive option for environmentally conscious consumers. Furthermore, the carbon sequestration potential of algae cultivation aligns with global efforts to combat climate change. This growing emphasis on sustainability is likely to drive investment and innovation within the algae sector, potentially leading to a market expansion of over 10% in the coming years.