Almond Market Summary

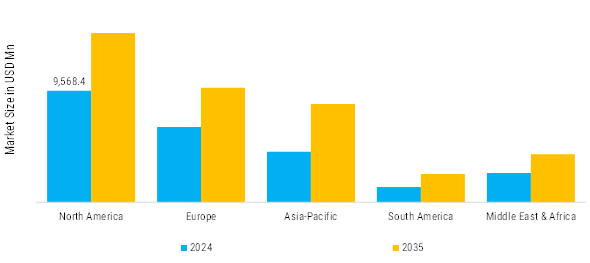

As per Market Research Future analysis, the Almond Market Size was estimated at USD 24,184.27 Million in 2024. The Almond Market industry is projected to grow from USD 25,274.98 Million in 2025 to 39,288.85 USD Million by 2035, exhibiting a compound annual growth rate (CAGR) of 4.51% during the forecast period 2025 - 2035.

Key Market Trends & Highlights

The Almond Market is experiencing reflect strong growth fueled by health-conscious consumers and plant-based innovations.

- Genome-edited rootstocks enhance salinity tolerance, aiding production in water-stressed areas like California's Central Valley. Carbon-credit premiums for low-water almonds emerge in North America and Australia, supporting eco-friendly farming. Mechanized orchards expand efficiency, countering labor shortages.

- Functional almond products like protein-enriched snacks gain traction amid rising fitness trends worldwide. Almond butter sees double-digit growth in Europe due to its use in keto and paleo diets.

- Precision agriculture with AI-driven irrigation optimizes water use, vital for drought-prone regions like Australia. Blockchain traceability enhances premium branding for organic almonds in export markets.

- Single-serve pouches dominate portable snacking, up 15% annually in North America. Resealable eco-packs reduce waste, aligning with zero-plastic mandates in Europe. Premium gift tins surge during festive seasons in Middle East markets.

- Diversified sourcing from Spain and Iran mitigates California weather risks. Cold-chain investments cut spoilage in tropical import hubs like Vietnam. Vertical integration by processors secures kernel quality amid raw material fluctuations.

Market Size & Forecast

| 2024 Market Size | 24,184.27 (USD Million) |

| 2035 Market Size | 39,288.85 (USD Million) |

| CAGR (2025 - 2035) | 4.51% |

Major Players

Blue Diamond growers, Treehouse California Almonds LLC, Barry Callebaut, Royal Nut Company, Olam Group Limited, Harris Woolf Almonds, Almondco Australia, Borges Agricultural & Industrial Nuts, Select Harvest Limited, and Mariani Nut Company.