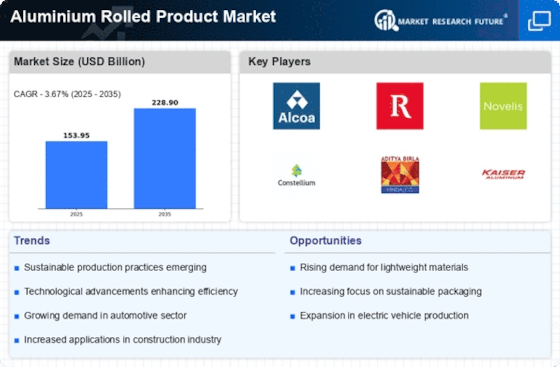

Growth in Packaging Applications

The Aluminium Rolled Product Market is witnessing significant growth in packaging applications, driven by the increasing demand for sustainable and recyclable materials. Aluminium rolled products are extensively used in the packaging sector for food and beverage containers, as they offer excellent barrier properties and are lightweight. In 2025, it is anticipated that the packaging industry will account for approximately 20% of the total aluminium consumption. This trend is further supported by consumer preferences for eco-friendly packaging solutions, as aluminium is 100% recyclable without loss of quality. As companies strive to meet sustainability goals, the Aluminium Rolled Product Market is likely to see a continued rise in demand for rolled products, reflecting the broader shift towards sustainable packaging solutions.

Rising Demand from Automotive Sector

The Aluminium Rolled Product Market is experiencing a notable surge in demand from the automotive sector. This trend is primarily driven by the industry's shift towards lightweight materials to enhance fuel efficiency and reduce emissions. In 2025, it is estimated that the automotive sector will account for approximately 30% of the total aluminium consumption, with rolled products being a significant contributor. Manufacturers are increasingly utilizing aluminium rolled products for body panels, structural components, and heat exchangers. This shift not only aligns with regulatory requirements but also meets consumer preferences for environmentally friendly vehicles. As automakers continue to innovate and adopt advanced materials, the Aluminium Rolled Product Market is poised for substantial growth, reflecting the broader trends in sustainability and efficiency within the automotive landscape.

Increasing Focus on Energy Efficiency

The increasing focus on energy efficiency is driving the Aluminium Rolled Product Market as industries seek to reduce their carbon footprint. Aluminium rolled products are recognized for their energy-saving properties, particularly in applications such as HVAC systems and electrical conductors. In 2025, it is projected that energy-efficient applications will account for around 15% of the total aluminium consumption. This trend is further supported by regulatory frameworks promoting energy efficiency across various sectors. As companies strive to comply with these regulations and enhance their sustainability profiles, the demand for aluminium rolled products is likely to rise. Consequently, the Aluminium Rolled Product Market stands to benefit from this growing emphasis on energy efficiency, reflecting broader environmental concerns.

Infrastructure Development Initiatives

Infrastructure development initiatives are playing a crucial role in propelling the Aluminium Rolled Product Market forward. Governments and private entities are investing heavily in infrastructure projects, including bridges, railways, and buildings, which require durable and lightweight materials. In 2025, the construction sector is projected to consume around 25% of the total aluminium production, with rolled products being favored for their strength-to-weight ratio and corrosion resistance. The Aluminium Rolled Product Market benefits from this trend as it supplies essential materials for various applications, including roofing, cladding, and structural components. As urbanization continues to rise, the demand for aluminium rolled products in infrastructure projects is likely to increase, further solidifying the industry's position in the market.

Technological Innovations in Manufacturing

Technological innovations in manufacturing processes are significantly influencing the Aluminium Rolled Product Market. Advancements such as automation, artificial intelligence, and improved rolling techniques are enhancing production efficiency and product quality. In 2025, it is expected that the adoption of these technologies will lead to a reduction in production costs by approximately 15%, making aluminium rolled products more competitive against alternative materials. Furthermore, these innovations enable manufacturers to produce customized rolled products that meet specific customer requirements, thereby expanding market opportunities. As the industry embraces these technological advancements, the Aluminium Rolled Product Market is likely to experience increased competitiveness and growth, positioning itself favorably in the evolving materials landscape.