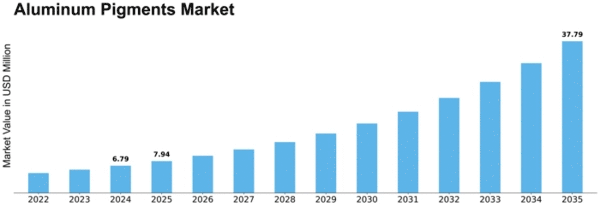

Aluminum Pigments Size

Aluminum Pigments Market Growth Projections and Opportunities

The aluminum pigments market is influenced by various market factors that play a significant role in its growth and dynamics. One crucial factor is the automotive industry's demand for aluminum pigments, driven by the need for coatings with aesthetic appeal and corrosion resistance. As automotive manufacturers strive to enhance the visual appeal of vehicles while ensuring durability, the demand for aluminum pigments in coatings for automotive paints continues to rise. Moreover, the construction sector contributes to the demand for aluminum pigments, particularly in architectural coatings where these pigments are utilized to impart metallic effects to surfaces, adding to the overall aesthetics of buildings. As construction activities surge globally, especially in emerging economies, the demand for aluminum pigments in architectural coatings is expected to witness steady growth.

Aluminum pigments are produced from aluminum powder using the wet-milling manufacturing process. Usually, mineral spirits and a fatty acid lubricant are added to the ball mills along with the aluminum powder. The slurry concentration of aluminum is only 4%. The fatty acid lubricant is used to prevent the cold welding of the pigment. These pigments withstand curing temperature of around 180°C.

Another significant market factor is the increasing preference for eco-friendly and sustainable products across various industries. Aluminum pigments offer advantages such as low VOC emissions and recyclability, aligning with the growing emphasis on sustainability in coatings and packaging industries. As environmental regulations become stricter, manufacturers are inclined towards using aluminum pigments in their products to comply with environmental standards while meeting consumer preferences for eco-friendly solutions. This trend is likely to propel the demand for aluminum pigments in the coming years.

Furthermore, technological advancements play a crucial role in shaping the aluminum pigments market. Innovations in pigment manufacturing processes lead to the development of advanced aluminum pigments with superior properties such as enhanced durability, better dispersion, and improved metallic effects. These technological advancements not only cater to the evolving needs of end-users but also drive efficiency in production processes, thereby positively impacting the market growth. Additionally, research and development activities focused on creating novel applications for aluminum pigments, such as inks, plastics, and textiles, broaden the market scope and foster innovation within the industry.

The global economic landscape also significantly influences the aluminum pigments market. Economic indicators such as GDP growth, industrial production, and consumer spending patterns impact the demand for aluminum pigments across various end-use industries. Economic stability and growth stimulate investments in construction, automotive, and packaging sectors, consequently driving the demand for aluminum pigments. Conversely, economic downturns or fluctuations may lead to reduced consumer spending and project delays, affecting the market demand for aluminum pigments negatively.

Moreover, geopolitical factors such as trade policies, tariffs, and international relations can have a notable impact on the aluminum pigments market. Changes in trade agreements or geopolitical tensions may disrupt the supply chain, leading to fluctuations in raw material prices and affecting market dynamics. Additionally, shifts in geopolitical alliances or regulatory changes in key aluminum-producing regions can influence the availability and pricing of aluminum pigments, thereby impacting market trends and profitability.

Leave a Comment