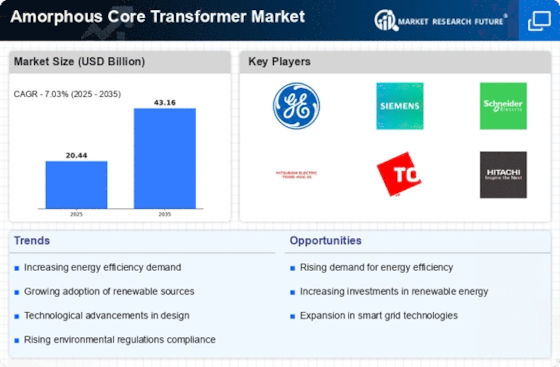

Technological Advancements

Technological advancements play a pivotal role in shaping the Amorphous Core Transformer Market. Innovations in materials and manufacturing processes have led to the development of more efficient and cost-effective amorphous core transformers. For instance, advancements in core material technology have enhanced the magnetic properties of amorphous steel, resulting in improved performance and reduced energy losses. Furthermore, the integration of smart grid technologies is facilitating the deployment of these transformers in modern electrical networks. As utilities invest in upgrading their infrastructure, the demand for advanced transformer solutions is likely to increase, thereby driving the Amorphous Core Transformer Market forward.

Integration with Renewable Energy

The integration of renewable energy sources is significantly influencing the Amorphous Core Transformer Market. As countries strive to meet renewable energy targets, the need for efficient power distribution systems becomes paramount. Amorphous core transformers are particularly well-suited for applications in wind and solar energy systems due to their high efficiency and ability to handle variable loads. Recent studies suggest that the adoption of these transformers in renewable energy projects can enhance overall system efficiency by reducing energy losses during transmission. This trend is expected to continue as investments in renewable energy infrastructure grow, further bolstering the Amorphous Core Transformer Market.

Regulatory Support and Incentives

Regulatory support and incentives are crucial drivers for the Amorphous Core Transformer Market. Governments worldwide are implementing policies aimed at reducing carbon emissions and promoting energy efficiency. These policies often include financial incentives for the adoption of energy-efficient technologies, including amorphous core transformers. For example, tax credits and rebates for energy-efficient equipment can significantly lower the initial investment costs for utilities and industries. As regulatory frameworks evolve to support sustainable practices, the demand for amorphous core transformers is likely to increase, thereby enhancing the growth prospects of the Amorphous Core Transformer Market.

Rising Demand for Energy Efficiency

The Amorphous Core Transformer Market is experiencing a notable surge in demand driven by the global emphasis on energy efficiency. As energy costs continue to rise, utilities and industries are increasingly seeking solutions that minimize energy losses. Amorphous core transformers, known for their lower no-load losses compared to traditional silicon steel transformers, are becoming a preferred choice. Recent data indicates that these transformers can reduce energy losses by up to 70%, making them an attractive option for energy-conscious organizations. This trend is further supported by regulatory frameworks that incentivize the adoption of energy-efficient technologies, thereby propelling the growth of the Amorphous Core Transformer Market.

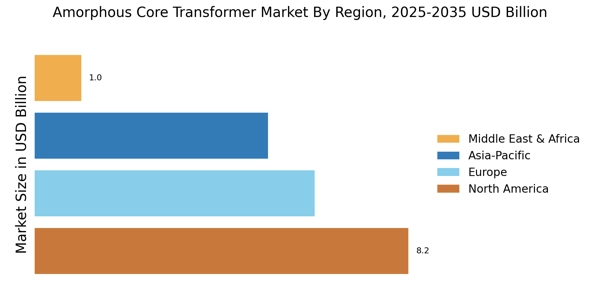

Growing Industrialization and Urbanization

The ongoing trends of industrialization and urbanization are contributing to the expansion of the Amorphous Core Transformer Market. As urban areas grow and industrial activities increase, the demand for reliable and efficient power distribution systems intensifies. Amorphous core transformers, with their superior efficiency and reduced energy losses, are becoming essential components in modern electrical grids. Data indicates that urbanization is expected to continue at a rapid pace, particularly in developing regions, leading to increased investments in electrical infrastructure. This trend is likely to drive the adoption of amorphous core transformers, thereby propelling the Amorphous Core Transformer Market forward.