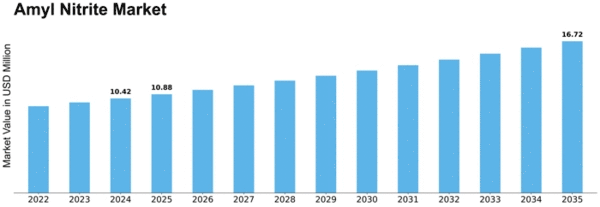

Amyl Nitrite Size

Amyl Nitrite Market Growth Projections and Opportunities

The Amyl Nitrite market is affected by many things. These all work together to create how it changes and grows. These things are very important in deciding how much people want to buy and sell, as well as the overall results of the market. Knowing these market things is very important for businesses and people who want to do well in the Amyl Nitrite business. The growing healthcare business is a big force behind the Amyl Nitrite market. As more people learn about health and medicine, the need for drugs like Amyl Nitrite is growing. The number of heart and blood vessel diseases is a major factor that affects the Amyl Nitrite market. Amyl Nitrite is sometimes used to help fix heart problems quickly. This makes it in demand for medical work. Studying and making new things in the medicine world affects how Amyl Nitrite is sold. New ways of making and using medicine help make Amyl Nitrite products different. This opens up new chances for the market to grow bigger. Strict rules and standards for obeying laws have a big effect on how Amyl Nitrite is made and sent out. Following quality and safety rules is very important. Changes to these guidelines can affect how markets work. Knowing more about how Amyl Nitrite helps and can be used makes people want to buy it, which grows the market. Ads by medicine makers and health groups are very important to how people think about things. The money situations such as growth of GDP, rates of inflation and income that can be used influence how much people can buy. Changes in economy can affect the demand for medicines, which then influences Amyl Nitrite market. Trade and world policies change the way Amyl Nitrite is sold. Altering rules for buying and selling goods between countries, as well taxes on imports can change how easy it is to get raw materials. This impacts the way markets work too. The constant improvements in the drug-making and factory businesses change how Amyl Nitrite is made. Technology changes make things work better, cost less and have higher quality. The competition in the Amyl Nitrite market affects how it works. This is because of big players and newcomers who are active in this area changing things around. Strategies, takeovers and partnerships help to make changes in the market. People are getting worried about saving the environment. This affects how well Amyl Nitrite is doing in the market. Businesses are paying more attention to being green. Customers like products that help the environment and this effects what people buy in markets.

Leave a Comment