Growth in Healthcare Sector

The Nitrile Butadiene Rubber Market is benefiting from the expanding healthcare sector, where the demand for high-quality, durable materials is paramount. Nitrile butadiene rubber is widely used in the production of medical gloves, seals, and other healthcare-related products due to its excellent barrier properties and resistance to chemicals. As the global healthcare industry continues to grow, driven by an increasing focus on hygiene and safety, the demand for nitrile butadiene rubber is likely to rise. Market analysis indicates that the healthcare segment is becoming a significant contributor to the overall nitrile butadiene rubber consumption, suggesting a favorable outlook for the industry.

Increasing Focus on Sustainability

The Nitrile Butadiene Rubber Market is increasingly influenced by sustainability initiatives as consumers and manufacturers alike prioritize eco-friendly materials. The demand for sustainable alternatives is prompting manufacturers to explore bio-based nitrile butadiene rubber options, which could potentially reduce the environmental impact associated with traditional production methods. This shift towards sustainability is not only a response to consumer preferences but also aligns with regulatory pressures aimed at reducing carbon footprints. As the market adapts to these changes, the introduction of sustainable products is expected to create new opportunities for growth within the nitrile butadiene rubber sector.

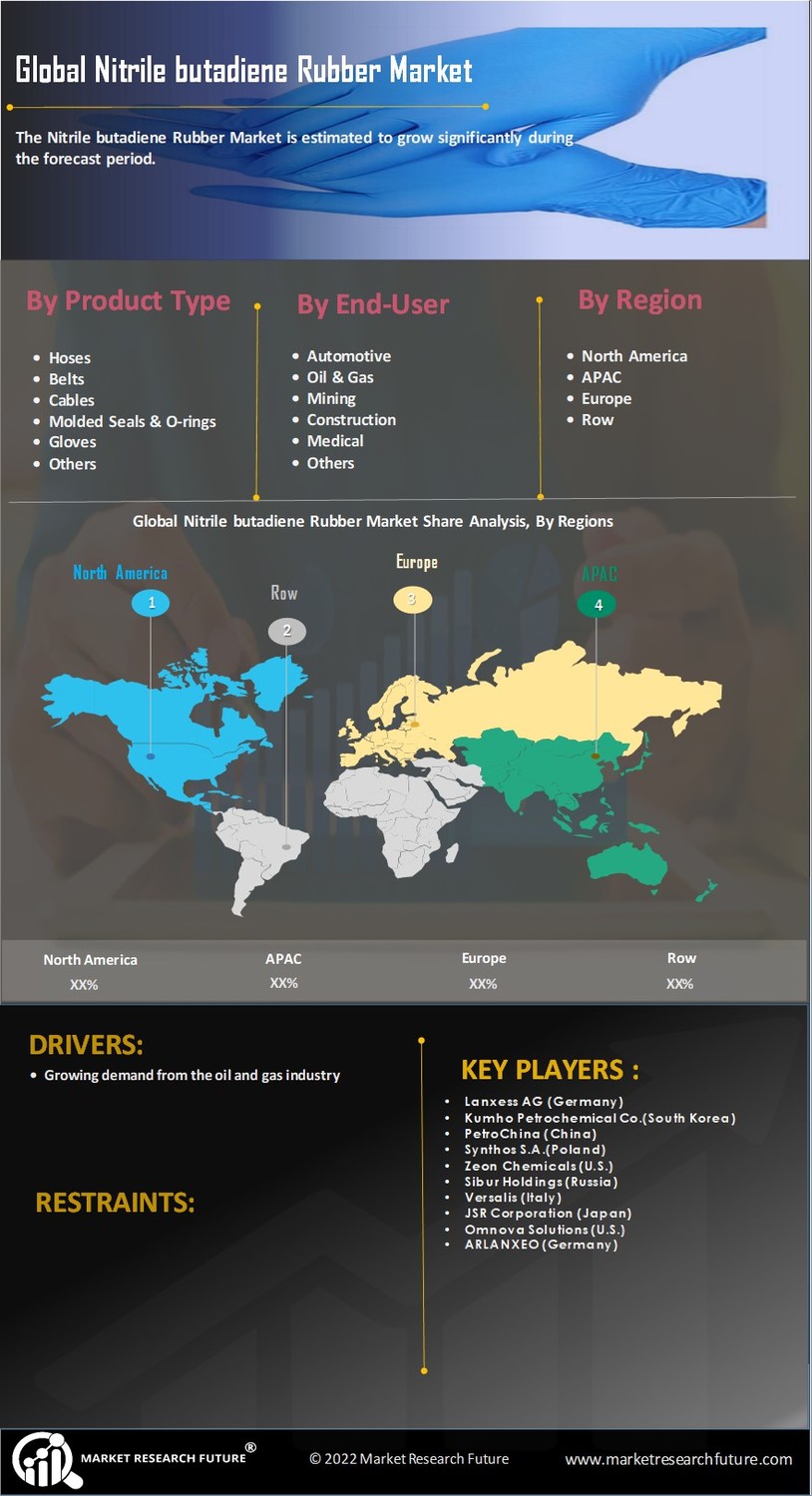

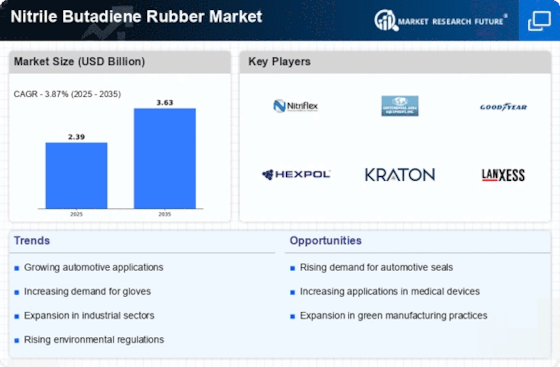

Expansion in Industrial Applications

The Nitrile Butadiene Rubber Market is witnessing significant growth due to its expanding applications across various industrial sectors. Industries such as oil and gas, manufacturing, and construction are increasingly utilizing nitrile butadiene rubber for its durability and resistance to harsh environments. This material is particularly favored for producing industrial gloves, conveyor belts, and protective equipment. The increasing focus on workplace safety and the need for reliable materials in industrial applications are likely to drive further demand. Market data reveals that the industrial segment is projected to contribute a considerable share to the overall nitrile butadiene rubber consumption, indicating a promising outlook for the industry.

Technological Innovations in Production

Technological advancements in the production processes of nitrile butadiene rubber are playing a crucial role in shaping the Nitrile Butadiene Rubber Market. Innovations such as improved polymerization techniques and the development of high-performance grades are enhancing the material's properties, making it more appealing for various applications. These advancements not only improve the efficiency of production but also reduce costs, thereby making nitrile butadiene rubber more accessible to a wider range of industries. As manufacturers continue to invest in research and development, the market is likely to see an influx of new products that meet the evolving needs of consumers, further propelling the industry's growth.

Rising Demand in Automotive Applications

The Nitrile Butadiene Rubber Market is experiencing a notable surge in demand, particularly from the automotive sector. This increase is largely attributed to the material's excellent resistance to oils, fuels, and other chemicals, making it an ideal choice for various automotive components such as seals, gaskets, and hoses. As the automotive industry continues to evolve, with a focus on enhancing vehicle performance and safety, the demand for high-quality materials like nitrile butadiene rubber is expected to grow. Recent data indicates that the automotive sector accounts for a substantial portion of the overall nitrile butadiene rubber consumption, suggesting a robust market trajectory in the coming years.