Top Industry Leaders in the Nitrite butadiene rubber Market

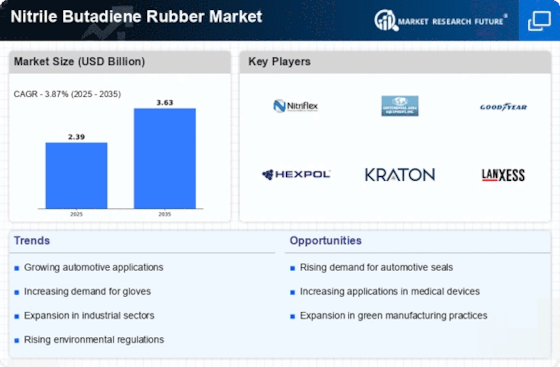

Nitrile Butadiene Rubber Market

Nitrile butadiene rubber (NBR), a versatile synthetic rubber, finds its way into a multitude of applications, from automotive parts to medical gloves. the NBR market is a dynamic space where competition thrives. Let's delve into the strategies, factors influencing market share, and recent developments shaping this landscape.

Strategies Adopted by Market :

-

Product Diversification: Leading players like Arkema, Lanxess, and Zeon Corporation are expanding their NBR portfolios to cater to specific application demands. This includes developing grades with enhanced oil resistance, high abrasion tolerance, and low-temperature flexibility. -

Geographical Expansion: Asian markets, particularly China and India, are witnessing a surge in NBR demand driven by robust automotive and infrastructure sectors. Companies are strategically setting up production facilities in these regions to capitalize on this growth. -

Technological Innovation: Sustainability is becoming a key differentiator. Companies are investing in eco-friendly NBR production processes and bio-based alternatives to acrylonitrile, a key NBR raw material with environmental concerns. -

Vertical Integration: Some players are integrating backwards by acquiring raw material suppliers to secure supply chains and control costs. This is particularly relevant in light of volatile oil prices impacting butadiene, another NBR raw material. -

Acquisitions and Partnerships: Mergers and acquisitions are consolidating the market, while strategic partnerships are enabling players to access new technologies, markets, and customer segments.

Factors Influencing Market Share:

-

Product Quality and Consistency: NBR applications often demand stringent performance specifications. Reliable suppliers with consistent product quality hold a significant advantage. -

Pricing and Manufacturing Efficiency: Cost-effective production processes and competitive pricing are crucial for attracting customers, especially in price-sensitive segments. -

Customer Relationships and Distribution Networks: Strong customer relationships and robust distribution networks ensure timely delivery and access to diverse markets. -

Regulatory Compliance: Meeting stringent regulations related to product safety and environmental impact is crucial for market entry and sustained growth.

Key Players

-

ARLANXEO

-

Zeon Chemicals L.P.

-

NITRIFLEX

-

SIBUR

-

PetroChina Company Limited

-

Dynasol Group

-

Synthos S.A.

-

KUMHO PETROCHEMICAL

-

LG Chem

-

Versalis S.p.A.

-

JSR Corporation

-

AirBoss of America

Recent Developments :

-

March 2023: The global NBR market experiences a slight growth due to increased demand from the construction sector, particularly in emerging economies. -

April 2023: The US Department of Commerce imposes anti-dumping duties on NBR imports from China, impacting market dynamics in North America. -

May 2023: Several NBR manufacturers announce price increases due to rising butadiene costs, putting pressure on downstream industries. -

June 2023: The NBR market remains stable, with ongoing demand from the automotive and medical sectors balancing the price hike impact.