Styrene-Butadiene Rubber market Summary

As per Market Research Future analysis, the Styrene-Butadiene Rubber Market Size was estimated at 4.952 USD Billion in 2024. The Styrene-Butadiene Rubber industry is projected to grow from 5.194 USD Billion in 2025 to 8.381 USD Billion by 2035, exhibiting a compound annual growth rate (CAGR) of 4.9% during the forecast period 2025 - 2035

Key Market Trends & Highlights

The Styrene-Butadiene Rubber Market is poised for growth driven by sustainability and technological advancements.

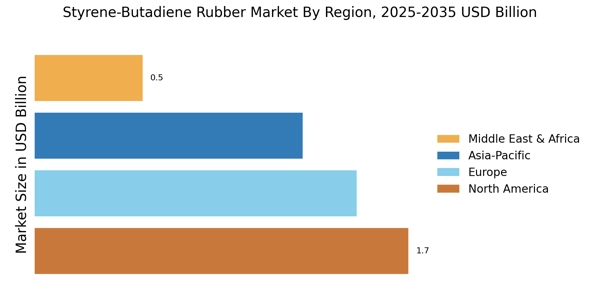

- North America remains the largest market for Styrene-Butadiene Rubber Market, primarily due to its robust automotive sector.

- Asia-Pacific is emerging as the fastest-growing region, fueled by increasing demand for innovative applications.

- Emulsion SBR continues to dominate the market, while Solution SBR is gaining traction as a preferred choice for new applications.

- Rising demand in the automotive sector and expansion in footwear applications are key drivers propelling market growth.

Market Size & Forecast

| 2024 Market Size | 4.952 (USD Billion) |

| 2035 Market Size | 8.381 (USD Billion) |

| CAGR (2025 - 2035) | 4.9% |

Major Players

Kraton Corporation (US), Asahi Kasei Corporation (JP), LG Chem Ltd. (KR), SABIC (SA), TSRC Corporation (TW), LyondellBasell Industries N.V. (NL), Goodyear Tire & Rubber Company (US), Continental AG (DE), Bridgestone Corporation (JP), Michelin (FR)