Market Analysis

In-depth Analysis of Analytics as a service Market Industry Landscape

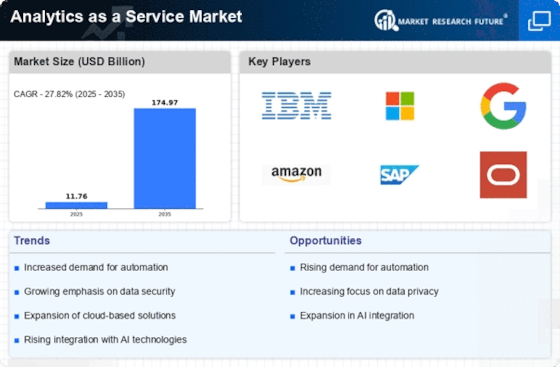

As businesses realize how useful it is to use advanced data to make decisions, the AaaS market has grown a lot. One big cause is the need for flexible and affordable analytics solutions, along with the fact that companies are creating an increasing amount of data at an exponential rate. By letting businesses use the power of analytics without having to build and maintain a lot of their own technology and knowledge, AaaS companies offer an appealing value offering.

The AaaS market is very competitive, with both well-known companies and innovative newcomers vying for the top spot. Cloud service companies with a lot of experience, like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform, now offer data products. At the same time, niche companies have sprung up that offer analytics solutions that are specifically designed for certain businesses or use cases. There are a lot of choices, which makes the market competitive. Suppliers must always try to stand out by offering new ideas, benefits, and better service.

As a way to stay ahead of the competition, both large and small companies use AaaS to make choices based on data. Because AaaS systems are flexible, businesses can use advanced data tools without having to spend a lot of money up front. Making analytics more accessible to everyone has grown the market and opened the door for new companies to give customized solutions to niche markets. An important factor in the rise of the AaaS market is that businesses now operate all over the world. As businesses expand across countries, they need analytics tools that can work with a wide range of data sources and give them global insights. As a service (PaaS) providers offer options that can easily combine data from different areas, giving businesses with a global reach a single view.

As a result, the AaaS market faces a number of problems. Companies that are thinking about using cloud-based analytics services have given problems with protecting personal data and keeping it private a lot of thought. AaaS companies use strong security measures, legal systems, and encryption methods to keep their clients' data safe. Additionally, changes to regulations and data security laws have an effect on the way the market works, so service providers need to be able to adapt to novel legal situations.

Similarly, changes in technology have an effect on how the AaaS market works. These days, adding machine learning (ML) and artificial intelligence (AI) features is one of the best ways for data services to stand out. Cloud-based service companies are spending money on cutting-edge data tools to help them make predictions and suggestions. This lets businesses do more than just look at old info; it lets them be proactive.

Leave a Comment