Cost Efficiency and Scalability

Cost efficiency remains a critical driver for the analytics as-a-service market. By adopting analytics as a service, organizations can significantly reduce their capital expenditures associated with infrastructure and software. This model allows businesses to pay only for the services they use, which can lead to savings of up to 30% compared to traditional analytics solutions. Furthermore, the scalability offered by these services enables companies to adjust their analytics capabilities in response to changing business needs. As a result, the analytics as-a-service market is attractive to organizations looking to optimize their operational costs while maintaining flexibility.

Integration of Advanced Analytics Tools

The integration of advanced analytics tools into existing business processes is a key driver for the analytics as-a-service market. Organizations are increasingly adopting tools that incorporate predictive analytics, machine learning, and artificial intelligence to enhance their analytical capabilities. This trend is indicative of a broader shift towards more sophisticated data analysis methods that can provide deeper insights. As businesses strive to leverage these advanced tools, the analytics as-a-service market is likely to see continued growth, as it offers the necessary infrastructure and expertise to support these initiatives.

Regulatory Compliance and Data Governance

In an era of heightened regulatory scrutiny, compliance with data governance standards is becoming increasingly important for organizations. The analytics as-a-service market is responding to this need by providing solutions that help businesses adhere to regulations such as GDPR and CCPA. These services often include built-in compliance features that simplify the process of managing data privacy and security. As organizations strive to avoid costly penalties and reputational damage, the demand for analytics solutions that prioritize compliance is likely to grow, further driving the analytics as-a-service market.

Growing Demand for Data-Driven Decision Making

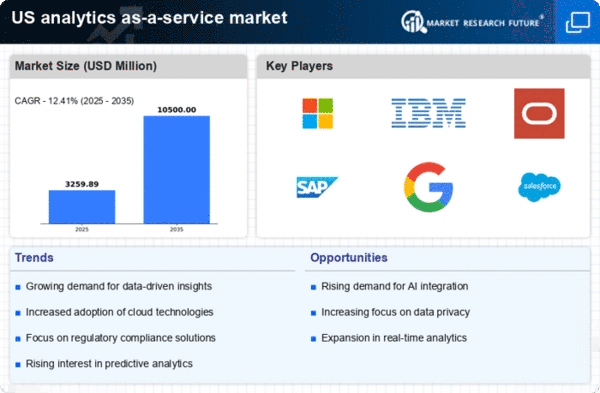

the analytics as-a-service market is experiencing a surge in demand as organizations increasingly recognize the value of data. Companies are leveraging analytics to gain insights into customer behavior, operational efficiency, and market trends. According to recent estimates, the market is projected to grow at a CAGR of approximately 25% over the next five years. This growth is fueled by the need for businesses to remain competitive in a rapidly evolving landscape. As organizations seek to harness the power of data, the analytics as-a-service market is positioned to play a pivotal role in enabling informed decision-making processes.

Enhanced Customer Experience through Personalization

The analytics as-a-service market is significantly influenced by the growing emphasis on enhancing customer experience through personalization. Organizations are utilizing analytics to tailor their offerings to individual customer preferences, thereby increasing engagement and loyalty. Data indicates that personalized marketing can lead to conversion rates that are 10 times higher than non-personalized approaches. As businesses recognize the importance of customer-centric strategies, the analytics as-a-service market is expected to expand as companies seek to implement advanced analytics capabilities that facilitate personalized interactions.