Rise of Advanced Analytics Tools

The Self-Service Analytics Market is witnessing a rise in advanced analytics tools that cater to the needs of diverse users. These tools are designed to simplify complex data analysis processes, making it easier for users to generate insights without extensive technical knowledge. The integration of intuitive interfaces and visualization capabilities allows users to interact with data more effectively. Market data suggests that the adoption of these advanced tools is expected to increase by over 30% in the coming years, as organizations prioritize user-friendly solutions. This trend not only enhances user engagement but also drives the overall growth of the self-service analytics market, as more individuals become capable of leveraging data for their specific needs.

Growing Demand for Data-Driven Decision Making

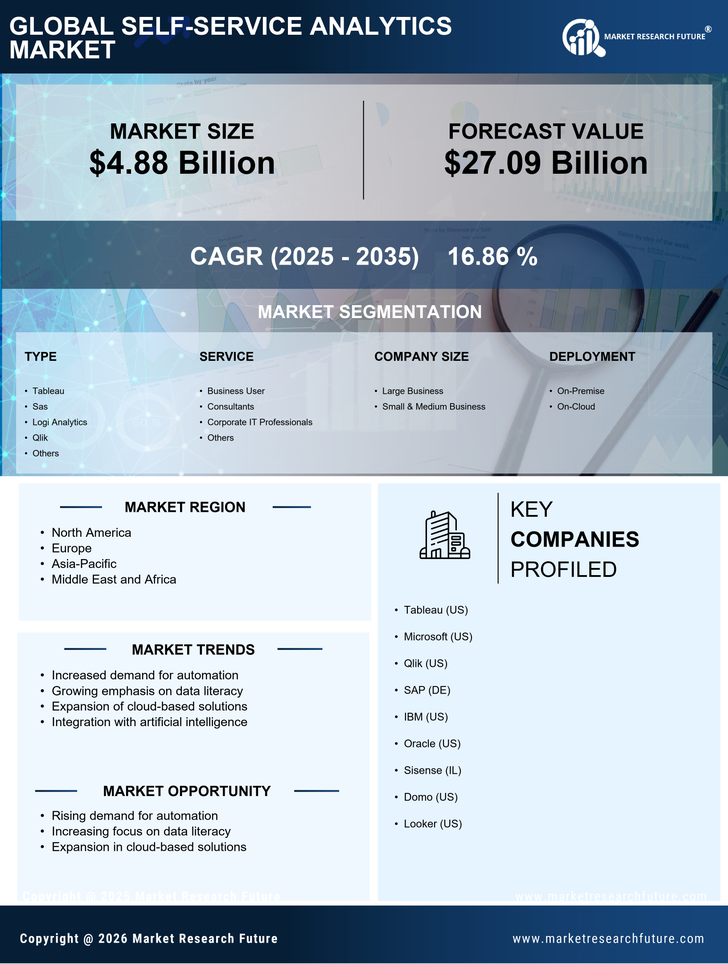

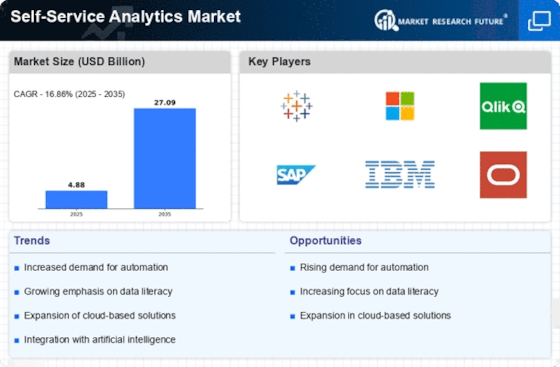

The Self-Service Analytics Market is experiencing a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. Companies are seeking to empower employees at all levels with the ability to analyze data independently, thereby enhancing operational efficiency and strategic planning. According to recent estimates, the market is projected to grow at a compound annual growth rate of approximately 25% over the next five years. This trend indicates a shift towards democratizing data access, allowing non-technical users to derive insights without relying heavily on IT departments. As businesses strive to remain competitive, the emphasis on self-service analytics tools is likely to intensify, fostering a culture of data literacy and informed decision-making across various sectors.

Increased Focus on Data Governance and Security

As the Self-Service Analytics Market expands, organizations are placing a heightened emphasis on data governance and security. With the proliferation of data access among non-technical users, ensuring data integrity and compliance with regulations becomes paramount. Companies are investing in robust governance frameworks to manage data access and usage effectively. This focus on security is likely to drive the development of self-service analytics solutions that incorporate advanced security features, such as role-based access controls and data encryption. Market analysts indicate that the demand for secure self-service analytics tools could increase by 40% as organizations seek to balance accessibility with stringent security measures, thereby fostering trust in data-driven initiatives.

Emergence of Mobile Self-Service Analytics Solutions

The Self-Service Analytics Market is witnessing the emergence of mobile self-service analytics solutions, catering to the growing need for on-the-go data access. As mobile devices become ubiquitous in the workplace, organizations are increasingly adopting mobile analytics tools that allow users to analyze data anytime and anywhere. This shift is particularly relevant in industries where timely decision-making is critical. Market data suggests that the mobile analytics segment is projected to grow by over 50% in the next few years, reflecting the demand for flexibility and accessibility in data analysis. By enabling users to engage with data through mobile platforms, organizations can enhance productivity and responsiveness, further driving the growth of the self-service analytics market.

Integration of Self-Service Analytics with Business Intelligence

The Self-Service Analytics Market is increasingly integrating with traditional business intelligence (BI) systems, creating a more cohesive data ecosystem. This integration allows organizations to leverage existing BI investments while enhancing user accessibility to analytics tools. By combining self-service capabilities with established BI frameworks, companies can provide users with a comprehensive view of data, facilitating better insights and decision-making. Market trends indicate that this integration is expected to grow by approximately 35% in the next few years, as organizations recognize the benefits of a unified approach to data analysis. This trend not only streamlines workflows but also enhances the overall effectiveness of analytics initiatives.