Growing Emphasis on Real-Time Analytics

In the context of the self service-analytics market, the growing emphasis on real-time analytics is becoming increasingly apparent in Japan. Businesses are recognizing the necessity of accessing and analyzing data in real-time to respond swiftly to market changes and customer needs. This trend is particularly relevant in sectors such as retail and finance, where timely insights can significantly impact decision-making. Approximately 60% of organizations in Japan are investing in real-time analytics capabilities, which is driving the demand for self service-analytics solutions that can provide immediate insights. Consequently, the self service-analytics market is likely to evolve, with a focus on tools that enable users to derive actionable insights from live data streams.

Expansion of Training and Support Services

The self service-analytics market in Japan is witnessing an expansion of training and support services aimed at enhancing user proficiency. As organizations adopt self service-analytics tools, the need for effective training programs becomes evident. Companies are increasingly investing in workshops and online courses to equip employees with the necessary skills to leverage analytics tools effectively. This focus on education is expected to drive user engagement and satisfaction, ultimately contributing to the growth of the self service-analytics market. Furthermore, as more users become proficient in utilizing these tools, organizations may experience improved decision-making processes and operational efficiencies, reinforcing the value of self service-analytics solutions.

Rising Demand for Data-Driven Decision Making

The self service-analytics market in Japan experiences a notable surge in demand as organizations increasingly recognize the value of data-driven decision making. This trend is driven by the need for businesses to enhance operational efficiency and improve customer satisfaction. According to recent statistics, approximately 70% of Japanese companies are prioritizing data analytics to inform strategic decisions. This shift towards data-centric approaches is fostering a culture of analytics within organizations, leading to a greater reliance on self service-analytics tools. As a result, the The self service-analytics market is likely to expand. More companies are investing in solutions that empower employees to analyze data independently. This investment streamlines workflows and enhances productivity.

Technological Advancements in Analytics Tools

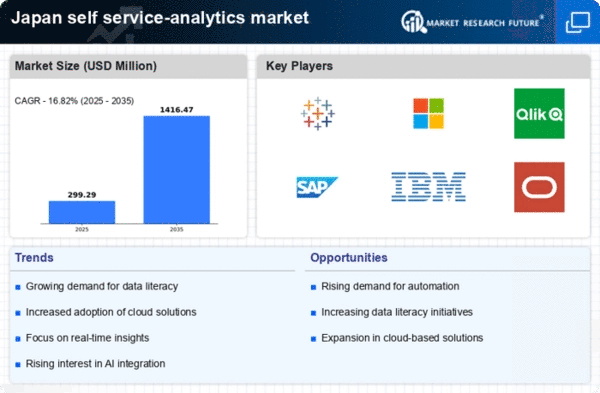

Technological advancements play a crucial role in shaping the self service-analytics market in Japan. Innovations in artificial intelligence (AI) and machine learning (ML) are enhancing the capabilities of analytics tools, making them more accessible and user-friendly. For instance, the integration of natural language processing (NLP) allows users to query data using everyday language, reducing the technical barrier for non-technical users. This democratization of data analytics is expected to drive market growth, as organizations seek to equip their workforce with intuitive tools that facilitate data exploration. The self service-analytics market is projected to witness a compound annual growth rate (CAGR) of around 15% over the next five years, reflecting the increasing adoption of these advanced technologies.

Increased Focus on Data Governance and Security

As the self service-analytics market continues to grow in Japan, there is an increased focus on data governance and security. Organizations are becoming more aware of the importance of protecting sensitive data while enabling users to access analytics tools. This awareness is leading to the implementation of robust data governance frameworks that ensure compliance with regulations and safeguard data integrity. Approximately 55% of companies in Japan are prioritizing data security measures in their analytics strategies. This trend is likely to influence the self service-analytics market, as vendors develop solutions that incorporate advanced security features, thereby instilling confidence among users and encouraging broader adoption of self service-analytics tools.