Market Trends

Key Emerging Trends in the Self Service Analytics Market

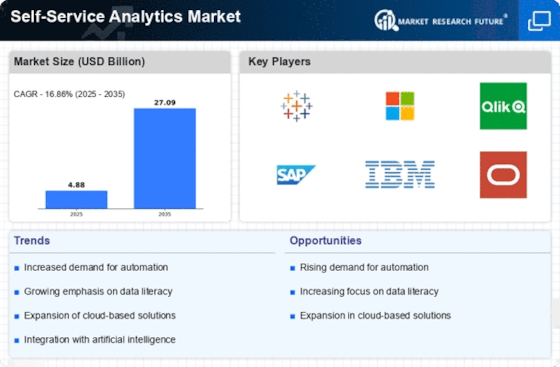

Self-service analytics market has seen a critical flood lately, mirroring the developing interest for easy-to-understand instruments that engage people to investigate and decipher information without broad specialized skill. This market pattern is powered by the rising acknowledgment of the worth that information holds for organizations across different businesses. As associations endeavour to turn out to be more information driven, the requirement for self-administration investigation apparatuses has become vital.

One conspicuous market pattern is the reception of cloud-based self-administration investigation arrangements. Organizations are progressively perceiving the advantages of distributed computing, and this stretches out to investigation too. Cloud-based self-administration examination stages offer adaptability, adaptability, and openness, permitting clients to break down information from anyplace with a web association. This pattern lines up with the more extensive shift toward cloud advancements across the business scene.

Besides, the self-service analytics market is seeing an expansion of easy-to-understand interfaces and instinctive dashboards. Tools designed for a wide range of users, including those without a strong background in data science or analytics, are receiving significant investment from vendors. The accentuation is on working on the client experience, empowering people from different divisions to bridle the force of examination for better navigation. This democratization of information is a vital driver in the market's development.

The integration of capabilities for ML and AI into self-service analytics tools is yet another striking development. These innovations improve the prescient and prescriptive examination abilities of the stages, giving clients more profound bits of knowledge and significant suggestions. As associations look to separate additional worth from their information, the combination of man-made intelligence and ML in self-administration examination is turning into an essential goal.

Moreover, the market is seeing expanded interest for constant investigation arrangements. In the present high speed business climate, the capacity to dissect and answer information progressively is pivotal. Organizations are able to act quickly to altering market conditions and customer inclinations by using self-service analytics tools having real-time capabilities.

Security and consistence are likewise arising as basic contemplations in the self-service analytics market. As associations handle touchy information, guaranteeing the security and consistence of self-administration examination apparatuses is foremost. Sellers are effectively tending to these worries by executing strong security elements and consistence conventions to impart trust in clients with respect to information protection and administrative adherence.

Besides, the market is encountering a shift towards inserted examination, where investigation capacities are consistently coordinated into existing business applications. This incorporation permits clients to get to investigation apparatuses inside the setting of their day-to-day work processes, killing the need to switch between various applications. Implanted examination improves client reception and add to a more durable way to deal with information driven navigation.

The self-service analytics market trends exhibit a dynamic landscape that adapts to the changing requirements of businesses. The reception of cloud-based arrangements, accentuation on easy-to-use interfaces, mix of man-made intelligence and ML, continuous investigation, and an emphasis on security and consistence by and large shape the direction of oneself help examination market. As associations keep on focusing on information driven independent direction, the market is ready for additional development and advancement.

Leave a Comment