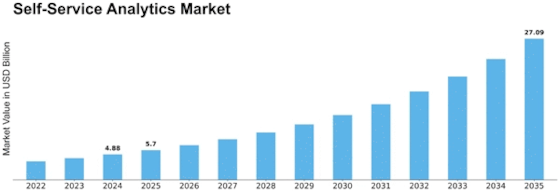

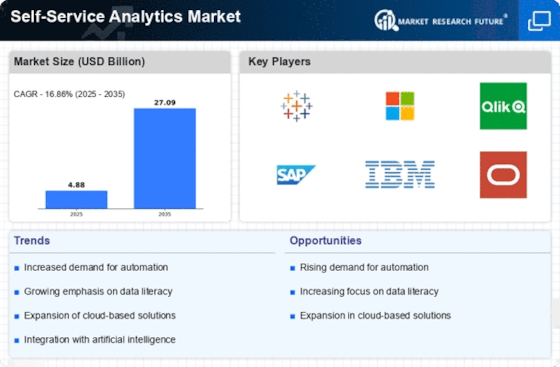

Self Service Analytics Size

Self Service Analytics Market Growth Projections and Opportunities

Self-service analytics market is consistently developing, driven by a large number of market factors that shape its development and direction. One key element is the rising interest for information driven dynamic across different enterprises. Associations are perceiving the significance of tackling the force of information to acquire bits of knowledge and remain cutthroat in the present unique business scene. Thus, oneself help examination market is seeing a flood in reception, as organizations look for easy to understand devices that engage non-specialized clients to dissect and decipher information without depending on IT offices.

The self-service analytics market is largely shaped by technological advancements. With the quick improvement of cutting-edge investigation instruments, AI, and computerized reasoning, clients can now get additional significant bits of knowledge from their information. The incorporation of these innovations into self-administration examination stages upgrades information handling abilities, empowering clients to reveal stowed away examples and patterns. Subsequently, associations are more disposed to put resources into self-administration examination arrangements that influence state of the art advances to drive development and proficiency in their dynamic cycles.

The developing accentuation on information administration and security is another basic market factor impacting the self-service analytics scene. As the volume of information created keeps on soaring, associations are progressively worried about keeping up with information trustworthiness, guaranteeing consistence with guidelines, and protecting touchy data. Responding to the security concerns of businesses and fostering trust in these platforms, vendors in the self-service analytics market are enhancing their solutions with robust data governance features, encryption mechanisms, and access controls.

Self-service analytics' significant market driver is the democratization of data. Conventional examination processes frequently elaborate particular information experts, making bottlenecks in information access and examination. Notwithstanding, self-administration investigation stages engage a more extensive scope of clients, including business investigators and departmental directors, to investigate and dissect information freely. This democratization speeds up direction as well as advances an information driven culture inside associations, where experiences are open to the people who need them, when they need them.

The ascent of distributed computing has essentially influenced self-service analytics market. As a result of their cost-effectiveness, scalability, and flexibility, cloud-based analytics solutions are appealing to businesses looking to improve their analytics infrastructure. Cloud arrangement empowers clients to get to and dissect information from anyplace, cultivating coordinated effort and guaranteeing continuous experiences. Additionally, the scalability of cloud solutions enables businesses to adapt to shifting data volumes and analytical requirements without making significant upfront hardware and infrastructure investments.

Market contest and seller elements are moulding the development of self-administration investigation contributions. As additional players enter the market, merchants are separating themselves through highlights, client experience, and combinations with other business applications. End-users will eventually benefit from assorted options and advanced tools for the data analysis for this competitive environment, which is driving modernization and pushing vendors to always amend their solutions.

The requirement for data-driven decision-making, technological progressions, data governance and security apprehensions, democratization of data, the influence of cloud computing, and the changing aspects of market competition all have an influence on the market. As associations keep on focusing on information examination as an essential objective, oneself help investigation market is ready for supported development and development before long.

Leave a Comment