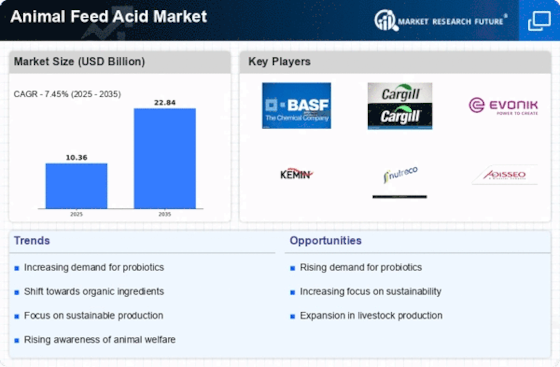

Rising Demand for Animal Protein

The increasing The Animal Feed Acid Industry. As consumers become more health-conscious, the preference for high-quality meat and dairy products intensifies. This trend is reflected in the projected growth of the livestock sector, which is expected to expand significantly in the coming years. Consequently, animal feed manufacturers are compelled to enhance feed quality, leading to a greater incorporation of feed acids. These acids not only improve nutrient absorption but also promote gut health, thereby increasing livestock productivity. The Animal Feed Acid Market is likely to benefit from this heightened demand, as producers seek to optimize feed formulations to meet consumer expectations.

Focus on Animal Health and Welfare

There is a growing emphasis on animal health and welfare, which is influencing the Animal Feed Acid Market. As livestock producers aim to enhance the overall well-being of their animals, the use of feed acids has become more prevalent. These acids are known to support digestive health, reduce the incidence of diseases, and improve feed efficiency. The increasing awareness of animal welfare standards is prompting farmers to adopt practices that ensure healthier livestock, which in turn drives the demand for specialized feed additives. The Animal Feed Acid Market is poised to expand as producers recognize the benefits of incorporating these acids into their feed formulations to promote better health outcomes for their animals.

Regulatory Support for Feed Additives

Regulatory frameworks supporting the use of feed additives are playing a crucial role in the Animal Feed Acid Market. Governments and regulatory bodies are increasingly recognizing the benefits of feed acids in promoting animal health and improving feed efficiency. This has led to the establishment of guidelines and standards that facilitate the safe use of these additives in animal nutrition. As regulations become more favorable, manufacturers are encouraged to invest in research and development to create innovative feed acid products. The Animal Feed Acid Market stands to gain from this supportive regulatory environment, as it fosters growth and encourages the adoption of feed acids among livestock producers.

Increasing Awareness of Feed Efficiency

The rising awareness of feed efficiency among livestock producers is significantly impacting the Animal Feed Acid Market. As feed costs represent a substantial portion of overall production expenses, farmers are increasingly seeking ways to optimize feed utilization. Feed acids have been shown to enhance nutrient absorption and improve feed conversion ratios, making them an attractive option for producers aiming to reduce costs. This focus on efficiency is driving the demand for specialized feed formulations that incorporate these acids. The Animal Feed Acid Market is likely to expand as producers recognize the economic benefits associated with improved feed efficiency, leading to a greater adoption of feed acid products.

Technological Innovations in Feed Production

Technological advancements in feed production are reshaping the Animal Feed Acid Market. Innovations such as precision fermentation and advanced processing techniques are enabling manufacturers to produce high-quality feed acids more efficiently. These technologies not only enhance the efficacy of feed acids but also reduce production costs, making them more accessible to livestock producers. The integration of data analytics and automation in feed manufacturing processes is further streamlining operations, allowing for better quality control and consistency. As these technologies continue to evolve, the Animal Feed Acid Market is likely to experience increased competition and growth, as producers seek to leverage these innovations to improve their product offerings.