Focus on Nutritional Quality

There is a notable emphasis on the nutritional quality of animal feed, which is significantly influencing the Animal Protein Feed Material Market. Livestock producers are increasingly aware of the impact of feed composition on animal health and productivity. As a result, there is a shift towards high-quality protein sources that enhance growth rates and feed conversion efficiency. Recent studies indicate that feed formulations enriched with essential amino acids can improve livestock performance. This focus on nutritional quality not only supports animal welfare but also aligns with consumer preferences for sustainably produced meat, thereby propelling the Animal Protein Feed Material Market forward.

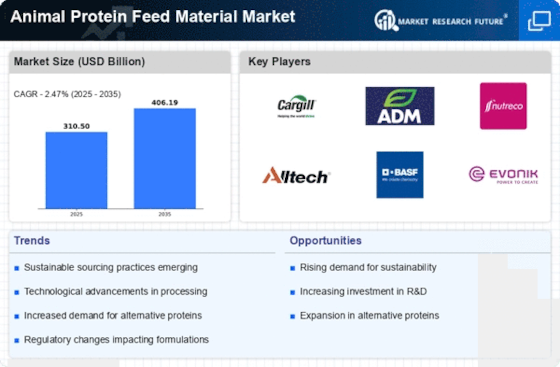

Rising Demand for Animal Protein

The increasing The Animal Protein Feed Material Industry. As more consumers seek protein-rich diets, the demand for livestock and poultry products escalates. According to recent data, meat consumption is projected to grow by approximately 1.5% annually, leading to a heightened need for animal feed materials. This trend suggests that feed manufacturers must adapt to meet the growing requirements of livestock producers. Consequently, the Animal Protein Feed Material Market is likely to experience substantial growth as it aligns with the rising demand for animal protein, necessitating innovative feed solutions to enhance production efficiency.

Increasing Awareness of Animal Welfare

The growing awareness of animal welfare is influencing consumer preferences and, consequently, the Animal Protein Feed Material Market. Consumers are increasingly concerned about the conditions in which livestock are raised, leading to a demand for ethically sourced animal products. This shift in consumer behavior is prompting producers to adopt more humane practices, which often include the use of higher-quality feed that supports animal health. As a result, feed manufacturers are responding by developing products that align with these ethical considerations. This trend indicates that the Animal Protein Feed Material Market must adapt to meet the evolving expectations of consumers regarding animal welfare.

Regulatory Support for Sustainable Practices

Regulatory frameworks promoting sustainable agricultural practices are shaping the Animal Protein Feed Material Market. Governments are increasingly implementing policies that encourage the use of sustainable feed ingredients, which can reduce the environmental impact of livestock production. For instance, initiatives aimed at reducing greenhouse gas emissions from animal agriculture are prompting feed manufacturers to explore alternative protein sources, such as insect meal and plant-based proteins. This regulatory support is likely to foster innovation within the Animal Protein Feed Material Market, as companies seek to comply with sustainability standards while meeting the nutritional needs of livestock.

Technological Innovations in Feed Production

Technological advancements in feed production are revolutionizing the Animal Protein Feed Material Market. Innovations such as precision nutrition and feed formulation software are enabling producers to optimize feed efficiency and reduce waste. Moreover, the integration of biotechnology in feed ingredients is enhancing the digestibility and nutritional value of animal feed. Recent data suggests that the adoption of these technologies can lead to a 10-15% improvement in feed conversion ratios. As these technologies become more accessible, they are likely to drive growth in the Animal Protein Feed Material Market, allowing producers to meet the increasing demands for high-quality animal protein.

.png)