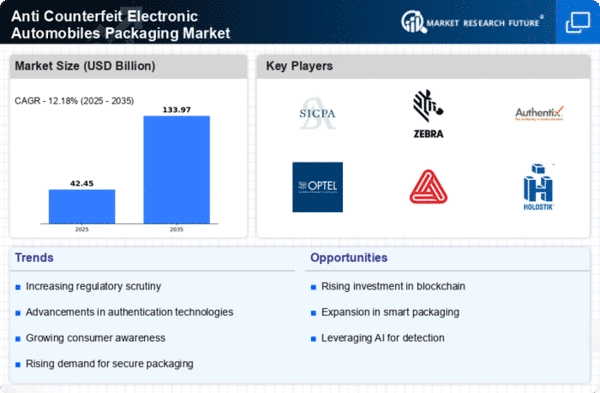

Market Growth Projections

The Global Anti Counterfeit Electronic And Automobiles Packaging Market Industry is poised for substantial growth, with projections indicating a market size of 37.9 USD Billion in 2024 and an anticipated increase to 134.0 USD Billion by 2035. This growth trajectory suggests a compound annual growth rate (CAGR) of 12.17% from 2025 to 2035. Such projections highlight the increasing importance of anti-counterfeiting measures in the packaging of electronic and automobile products. As manufacturers and consumers alike recognize the value of secure packaging solutions, the market is likely to expand, driven by technological advancements and heightened regulatory scrutiny.

Rising Demand for Authenticity

The increasing consumer demand for authenticity in products drives the Global Anti Counterfeit Electronic And Automobiles Packaging Market Industry. As consumers become more aware of counterfeit goods, particularly in electronics and automobiles, they seek assurance that their purchases are genuine. This trend is particularly evident in high-value items, where the risk of counterfeiting is substantial. For instance, the market is projected to reach 37.9 USD Billion in 2024, indicating a robust growth trajectory. Companies are investing in advanced packaging solutions that incorporate features like holograms and QR codes to enhance product verification, thereby fostering consumer trust.

Consumer Awareness and Education

Consumer awareness regarding the risks associated with counterfeit products is a driving force in the Global Anti Counterfeit Electronic And Automobiles Packaging Market Industry. Educational initiatives aimed at informing consumers about the dangers of counterfeit goods are gaining traction. As consumers become more knowledgeable, they are more likely to seek out products with verified authenticity. This shift in consumer behavior encourages manufacturers to adopt advanced packaging solutions that clearly communicate product authenticity. By investing in anti-counterfeiting technologies, companies can enhance their market position and cater to the growing demand for secure packaging.

Regulatory Pressures and Compliance

Regulatory frameworks aimed at combating counterfeiting are increasingly influencing the Global Anti Counterfeit Electronic And Automobiles Packaging Market Industry. Governments worldwide are implementing stringent regulations to protect consumers and ensure product integrity. For instance, the European Union has introduced regulations that mandate the use of anti-counterfeiting measures in packaging for certain products. Compliance with these regulations not only protects consumers but also enhances brand reputation. As a result, manufacturers are compelled to invest in advanced packaging solutions, which is likely to drive market growth at a CAGR of 12.17% from 2025 to 2035.

Growth of E-commerce and Online Sales

The rapid expansion of e-commerce significantly impacts the Global Anti Counterfeit Electronic And Automobiles Packaging Market Industry. As online shopping becomes increasingly prevalent, the risk of counterfeit products being sold through digital platforms rises. Consumers purchasing electronics and automobiles online are particularly vulnerable to counterfeit goods, prompting a demand for secure packaging solutions. Companies are responding by implementing robust anti-counterfeiting measures in their packaging to protect their brand and ensure customer satisfaction. This trend is expected to contribute to the market's growth, as businesses recognize the importance of safeguarding their products in the digital marketplace.

Technological Advancements in Packaging

Technological innovations play a pivotal role in shaping the Global Anti Counterfeit Electronic And Automobiles Packaging Market Industry. The integration of smart packaging technologies, such as RFID tags and blockchain, enhances traceability and security. These advancements allow manufacturers to monitor their products throughout the supply chain, significantly reducing the risk of counterfeiting. For example, RFID technology enables real-time tracking of products, which is crucial in the electronics sector. As the market evolves, the adoption of these technologies is expected to accelerate, contributing to an anticipated market growth to 134.0 USD Billion by 2035.