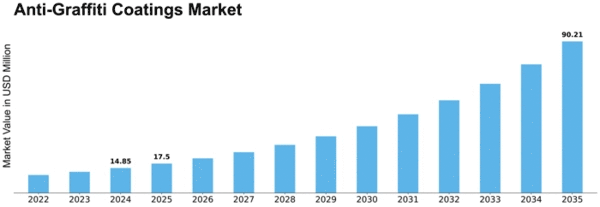

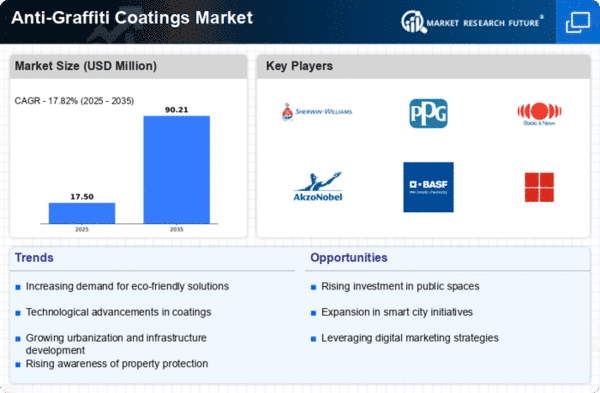

Anti Graffiti Coatings Size

Anti-Graffiti Coatings Market Growth Projections and Opportunities

The Anti-Graffiti Coatings market is influenced by several market drivers that determine how and how fast it grows. First, the abuse of graffiti in public places is increasing which has raised a demand for anti-graffiti solutions that are effective. As cities expand with more public spaces opening up, the need for superior anti-graffiti coverings also increases. This is because graffiti usually occurs more frequently in areas where there are many people.

The building and property sectors too have a substantial impact on the anti-graffiti paint market. The growth of these industries necessitates treatments to protect buildings and equipment from damage caused by graffiti. An increasing number of architects, contractors and property owners understand the importance of having measures against graffitism. This has resulted in increased application of better paints.

Market performance depends on the economy as well as disposable income levels of its participants. In times when economies are flourishing giving people extra cash to spare they spend their money on maintaining and protecting their homes. For example, this trend augurs well for the anti-graffiti coatings market since property owners may want to invest into preventive measures which shield their properties from being vandalized.

Many other factors that shape markets are affected by competitive forces as well. Competitiveness makes companies innovate novel ideas or make their products outstanding among others. As a result, there can be product improvements through changes in formulation aspects or methods employed during application process and those relating to general purpose or use. Thus consumers benefit because they now have a variety of good anti-graffiti choices available.

However, environmental protection has become increasingly important in the paint industry today unlike before. The fact that there is an expanding market for such coatings arises out of more people including businesses looking for eco-friendly as well as long lasting remedies against grafitti related issues. Consequently, makers produce products that protect against grafitti but hardly cause any harm to environment if any. This increases the overall size of the market.

Leave a Comment