Market Share

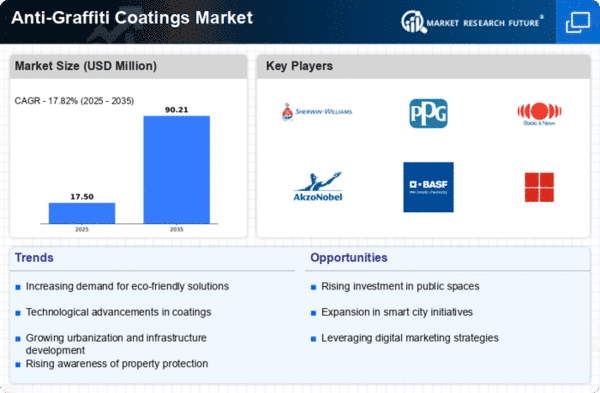

Anti-Graffiti Coatings Market Share Analysis

Different companies have been using smart market share positioning strategies as a result of increasing demand for anti-graffiti coatings across the globe. These coats work like shields that prevent writing from sticking on and make surfaces easy to wash. Key players employ various tactics to improve their position in the market and stay ahead of competition.

This strategy is being employed in Anti-Graffiti Coatings Market as a way of improving products. Businesses put a lot of money into research and development to make coverings that are more advanced and effective at stopping graffiti. Frequently occurring areas of innovation are longer-lasting coverings that can withstand harsh weather conditions and are easy to apply or use again. A company can become more popular by coming up with modern solutions which will attract more customers for them thus becoming market leaders themselves.

Market segmentation is heavily used by many companies so that they can have the right goods for each section of buyers. Anti-graffiti treatments must be applied to various surfaces in different ways. Companies often develop custom solutions for a wide range of applications such as public places, transportation, or building facades. By adopting this approach, firms can meet the distinct needs of various industries thereby making tailor-made products and gain a competitive advantage in some market segments.

Companies wishing to gain higher shares in the Anti-Graffiti Coatings Market should concentrate on expanding into new territories. Companies may identify new customers and expand their businesses by going into fresh areas and sites. Strategies that are reflective of area’s culture and surroundings can be employed to suit different areas’ tastes. Through adapting to different market situations, firms can attain sturdy bases in various parts of the world.

Market positioning depends greatly on the effectiveness of your marketing and branding work. Companies invest significant funds into creating a strong brand image through emphasizing features and benefits of their graffiti resistant coatings. Becoming known in your industry through digital marketing, social media efforts, attending events among others; you should be seen. A clear brand plan could set apart one company from others operating within similar spheres while altering perception about the business among its customers thus leading itself to more market share.

Quality controls system and licenses are very critical especially when it comes to getting people believe in any business under The Anti-Graffiti Coatings Market umbrella. Most times, companies subject their finishes through numerous tests for certifications that prove efficacy at workability issues over time as well as safety concerns involving lives of consumers using them respectively given those factors which was not only necessary requirement but also an opportunity created by regulators’ pressure driving research development on anti-graffiti paints which would work better yet environmental friendly coating substances.

Leave a Comment