Regulatory Frameworks

The establishment of stringent regulatory frameworks is significantly influencing the anti uav defence system Market. Governments are increasingly recognizing the need for comprehensive policies to manage the proliferation of drones and mitigate associated risks. These regulations often mandate the implementation of anti-drone systems in sensitive areas, such as airports, military bases, and critical infrastructure sites. As a result, the market is experiencing a surge in demand for compliant solutions that meet regulatory standards. By 2025, it is anticipated that regulatory compliance will drive a substantial portion of market growth, with an estimated increase of 20% in system deployments across various sectors. This regulatory push underscores the importance of aligning technological advancements with legal requirements.

Rising Security Concerns

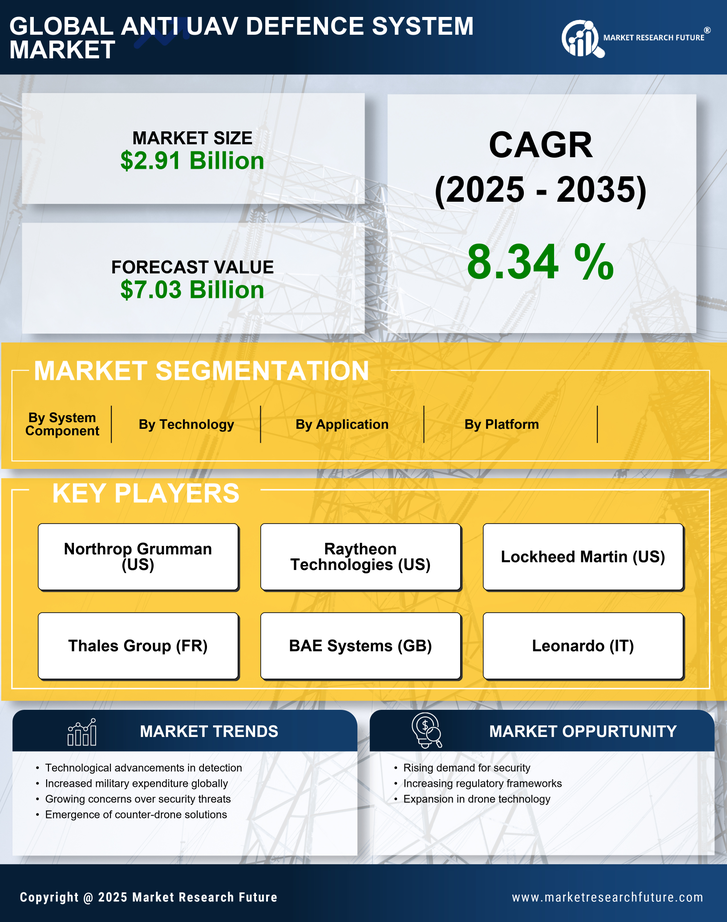

The increasing frequency of drone-related incidents has heightened security concerns across various sectors, including military, commercial, and civilian domains. As threats from unauthorized UAVs escalate, the demand for robust anti UAV defence systems intensifies. This trend is particularly evident in urban areas, where the potential for drone misuse poses significant risks. The Anti UAV Defence System Market is responding to these challenges by developing advanced detection and neutralization technologies. In 2025, the market is projected to grow at a compound annual growth rate of approximately 15%, driven by the urgent need for enhanced security measures. Governments and private entities are investing heavily in these systems to safeguard critical infrastructure and public safety, indicating a strong market trajectory.

Technological Innovations

Technological advancements play a pivotal role in shaping the Anti UAV Defence System Market. Innovations in radar, sensor technologies, and artificial intelligence are enhancing the capabilities of anti-drone systems. For instance, the integration of machine learning algorithms allows for improved target identification and tracking, thereby increasing operational efficiency. The market is witnessing a surge in the adoption of counter-drone technologies that utilize electronic warfare and kinetic interception methods. As of 2025, the market is expected to reach a valuation of USD 3 billion, reflecting the growing reliance on sophisticated technologies to counter UAV threats. This trend suggests that continuous investment in research and development will be crucial for maintaining competitive advantages in the industry.

Commercial Sector Expansion

The expansion of the commercial sector is significantly impacting the Anti UAV Defence System Market. As businesses increasingly adopt drone technology for various applications, including delivery services and surveillance, the need for protective measures against rogue UAVs becomes paramount. Industries such as logistics, agriculture, and energy are particularly vulnerable to drone-related threats, prompting investments in anti-drone solutions. By 2025, it is estimated that the commercial sector will represent approximately 30% of the market, driven by the necessity to safeguard operations and assets. This growth suggests that the anti UAV defence systems will evolve to cater to the unique requirements of commercial applications, further diversifying the market landscape.

Increased Military Expenditure

The rise in military expenditure across various nations is a key driver for the Anti UAV Defence System Market. As countries prioritize national security and defense capabilities, investments in counter-drone technologies are becoming a focal point. Military organizations are actively seeking advanced anti UAV systems to protect assets and personnel from potential drone threats. In 2025, military spending on anti-drone systems is projected to account for over 40% of the total market share, reflecting a strategic shift towards enhancing aerial defense mechanisms. This trend indicates that the military sector will continue to be a primary catalyst for innovation and growth within the industry, as nations strive to maintain technological superiority.