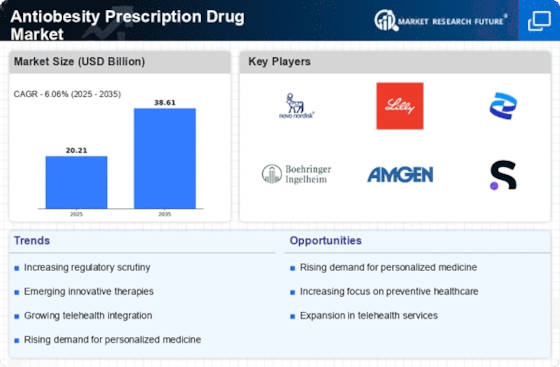

Rising Obesity Rates

The increasing prevalence of obesity is a primary driver for the Antiobesity Prescription Drug Market. According to recent data, approximately 42% of adults in certain regions are classified as obese, which has led to a heightened demand for effective weight management solutions. This alarming trend is prompting healthcare providers to seek pharmacological interventions to combat obesity-related health issues, such as diabetes and cardiovascular diseases. As the population continues to grow and age, the need for antiobesity medications is likely to escalate, thereby propelling the market forward. The Antiobesity Prescription Drug Market is thus positioned to expand significantly as more individuals seek medical assistance in managing their weight.

Advancements in Drug Development

Innovations in drug development are significantly influencing the Antiobesity Prescription Drug Market. Recent advancements have led to the introduction of new pharmacological agents that target specific pathways involved in appetite regulation and energy expenditure. For instance, medications that utilize novel mechanisms of action, such as GLP-1 receptor agonists, have shown promising results in clinical trials. The market is witnessing a shift towards more effective and safer options, which could potentially enhance patient adherence to treatment regimens. As these new therapies gain approval and enter the market, they are expected to attract a larger patient population, thereby driving growth in the Antiobesity Prescription Drug Market.

Supportive Regulatory Environment

A supportive regulatory environment is fostering growth within the Antiobesity Prescription Drug Market. Regulatory agencies are increasingly prioritizing the approval of new antiobesity medications, recognizing the urgent need for effective treatments in light of rising obesity rates. Streamlined approval processes and incentives for research and development are encouraging pharmaceutical companies to invest in this sector. As more drugs receive regulatory approval, the market is expected to see an influx of new products, enhancing competition and providing consumers with a wider array of treatment options. This regulatory support is crucial for the sustained growth of the Antiobesity Prescription Drug Market.

Increased Awareness of Health Risks

There is a growing awareness of the health risks associated with obesity, which is serving as a catalyst for the Antiobesity Prescription Drug Market. Public health campaigns and educational initiatives are effectively highlighting the link between obesity and chronic diseases, such as hypertension and type 2 diabetes. This heightened awareness is encouraging individuals to seek medical advice and explore pharmacological options for weight management. Furthermore, healthcare providers are increasingly recognizing the importance of addressing obesity as a critical component of overall health. As a result, the demand for antiobesity medications is likely to rise, contributing to the expansion of the Antiobesity Prescription Drug Market.

Integration of Technology in Treatment

The integration of technology into obesity treatment is emerging as a significant driver for the Antiobesity Prescription Drug Market. Digital health solutions, such as mobile applications and telemedicine, are increasingly being utilized to complement pharmacological interventions. These technologies facilitate better patient engagement and adherence to treatment plans, which can enhance the effectiveness of antiobesity medications. Moreover, the use of data analytics allows for personalized treatment approaches, tailoring medications to individual patient needs. As technology continues to evolve and become more integrated into healthcare, it is likely to play a pivotal role in shaping the future of the Antiobesity Prescription Drug Market.