Increasing Water Scarcity

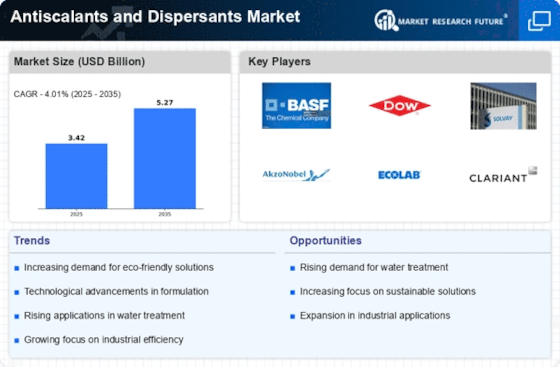

The rising concern over water scarcity is a pivotal driver for the Antiscalants and Dispersants Market. As freshwater resources become increasingly limited, industries are compelled to adopt advanced water treatment solutions. Antiscalants play a crucial role in preventing scale formation in water systems, thereby enhancing the efficiency of water usage. According to recent data, the demand for water treatment chemicals, including antiscalants, is projected to grow at a compound annual growth rate of approximately 6% over the next few years. This trend underscores the necessity for effective water management solutions, positioning the Antiscalants and Dispersants Market as a key player in addressing global water challenges.

Industrial Growth and Expansion

The ongoing industrial growth across various sectors, such as oil and gas, power generation, and manufacturing, significantly influences the Antiscalants and Dispersants Market. As industries expand, the need for efficient water treatment solutions becomes paramount to ensure operational efficiency and compliance with environmental regulations. For instance, the oil and gas sector, which heavily relies on water for extraction and processing, is expected to witness a surge in demand for antiscalants to mitigate scaling issues. This industrial expansion is anticipated to drive the market for antiscalants and dispersants, with projections indicating a market value increase of over 5 billion USD by 2027.

Rising Demand from the Energy Sector

The energy sector, particularly renewable energy, is emerging as a significant driver for the Antiscalants and Dispersants Market. As the world shifts towards sustainable energy sources, the need for efficient water management in energy production processes becomes critical. For instance, solar thermal power plants and geothermal energy systems require effective antiscalants to prevent scaling in heat exchangers and other equipment. This rising demand from the energy sector is anticipated to contribute to the overall growth of the market, with estimates suggesting an increase in market share by approximately 15% over the next five years. The Antiscalants and Dispersants Market is thus poised to play a vital role in supporting the energy transition.

Technological Innovations in Water Treatment

Technological advancements in water treatment processes are driving the evolution of the Antiscalants and Dispersants Market. Innovations such as advanced membrane technologies and automated monitoring systems are enhancing the efficiency of water treatment operations. These technologies often require specialized antiscalants to optimize performance and prevent fouling. The integration of smart technologies in water treatment is likely to create new opportunities for the market, as industries seek to improve operational efficiency and reduce costs. As a result, the Antiscalants and Dispersants Market is expected to witness a surge in demand for innovative solutions that align with these technological advancements.

Regulatory Compliance and Environmental Standards

Stringent regulatory frameworks and environmental standards are increasingly shaping the Antiscalants and Dispersants Market. Governments worldwide are implementing regulations aimed at reducing water pollution and promoting sustainable practices. As a result, industries are compelled to adopt effective water treatment solutions, including antiscalants, to comply with these regulations. The market is likely to benefit from this trend, as companies seek to enhance their environmental performance. Furthermore, the demand for eco-friendly and biodegradable antiscalants is on the rise, reflecting a shift towards sustainable practices in the industry. This regulatory landscape is expected to propel the growth of the Antiscalants and Dispersants Market in the coming years.