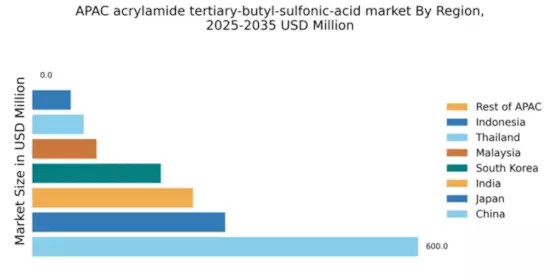

China : Robust Growth Driven by Demand

China holds a commanding market share of 60% in the acrylamide tertiary-butyl-sulfonic-acid market, valued at $600.0 million. Key growth drivers include rapid industrialization, increasing demand from the textile and paper industries, and supportive government policies promoting chemical manufacturing. The Chinese government has implemented initiatives to enhance production capabilities and environmental regulations, fostering a conducive environment for market expansion. Infrastructure development, particularly in transportation and logistics, further supports market growth.

India : Strong Demand from Diverse Sectors

India accounts for a market share of 25% with a value of $250.0 million in the acrylamide tertiary-butyl-sulfonic-acid sector. The growth is propelled by rising demand in agriculture, textiles, and construction industries. Government initiatives like 'Make in India' and investments in infrastructure are enhancing production capabilities. Regulatory frameworks are evolving to support sustainable practices, which is crucial for attracting foreign investment and boosting local production.

Japan : Advanced Applications in Industry

Japan holds a market share of 30% valued at $300.0 million, driven by technological advancements and high-quality production standards. The demand is primarily from the automotive and electronics sectors, where acrylamide tertiary-butyl-sulfonic-acid is used in various applications. The Japanese government supports R&D initiatives, fostering innovation in chemical manufacturing. Additionally, stringent regulations ensure high safety and environmental standards, enhancing market credibility.

South Korea : Key Player in Chemical Manufacturing

South Korea represents a market share of 20% with a value of $200.0 million in the acrylamide tertiary-butyl-sulfonic-acid market. The growth is driven by a robust industrial base, particularly in electronics and automotive sectors. Government policies promoting green technology and sustainable practices are shaping the market landscape. The competitive environment features major players like BASF and Mitsubishi, which are investing in local production facilities to meet rising demand.

Malaysia : Focus on Sustainable Development

Malaysia captures a market share of 10% valued at $100.0 million in the acrylamide tertiary-butyl-sulfonic-acid market. The growth is supported by government initiatives aimed at enhancing the chemical industry and promoting sustainable practices. Demand is increasing in sectors like agriculture and construction, where acrylamide is utilized for various applications. The Malaysian government is investing in infrastructure to support industrial growth, creating a favorable business environment.

Thailand : Emerging Hub for Production

Thailand holds a market share of 8% with a value of $80.0 million in the acrylamide tertiary-butyl-sulfonic-acid market. The country is becoming a strategic hub for chemical production and trade in Southeast Asia. Key growth drivers include increasing demand from the automotive and construction sectors, along with government support for industrial development. The competitive landscape features local and international players, enhancing market dynamics and innovation.

Indonesia : Growing Demand and Investment Opportunities

Indonesia accounts for a market share of 6% valued at $60.0 million in the acrylamide tertiary-butyl-sulfonic-acid market. The growth is driven by rising demand in agriculture and construction industries. Government initiatives aimed at boosting local manufacturing and attracting foreign investment are crucial for market expansion. The competitive landscape is evolving, with increasing interest from major players looking to establish a presence in this emerging market.

Rest of APAC : Potential for Future Growth

The Rest of APAC region currently shows no significant market activity in the acrylamide tertiary-butyl-sulfonic-acid sector, with a market value of $0.0 million. However, there is potential for future growth as countries in this region develop their chemical industries. Government initiatives aimed at industrialization and investment in infrastructure could pave the way for market entry. The competitive landscape remains largely untapped, presenting opportunities for new entrants and existing players to explore.