Growing Construction Activities

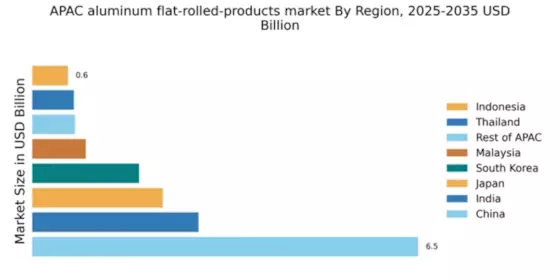

The aluminum flat-rolled-products market in APAC is experiencing a surge due to the rapid growth in construction activities across the region. Countries like India and China are investing heavily in infrastructure development, which is expected to drive demand for aluminum flat-rolled products. The construction sector is projected to grow at a CAGR of approximately 7% from 2025 to 2030, leading to increased consumption of aluminum materials. Aluminum's lightweight and corrosion-resistant properties make it an ideal choice for various applications in construction, including roofing, cladding, and window frames. As urbanization continues to rise, the aluminum flat-rolled-products market is likely to benefit significantly from this trend, with an anticipated increase in demand for high-quality aluminum sheets and coils.

Increased Focus on Lightweight Materials

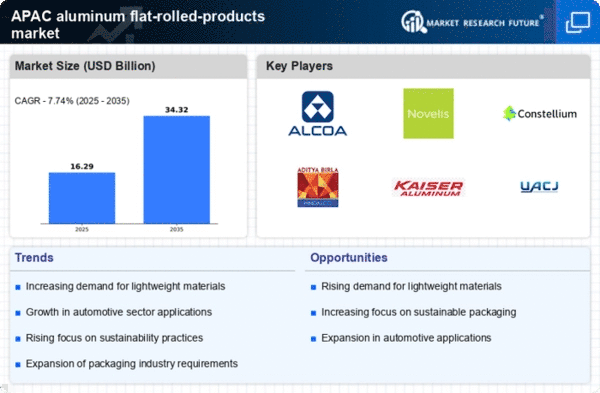

The aluminum flat-rolled-products market in APAC is witnessing a shift towards lightweight materials, particularly in the transportation sector. As manufacturers seek to enhance fuel efficiency and reduce emissions, aluminum flat-rolled products are becoming increasingly popular. The automotive industry, for instance, is projected to grow by approximately 5% annually, with a notable emphasis on lightweight components. This trend is further supported by government regulations aimed at reducing carbon footprints. Consequently, the aluminum flat-rolled-products market is likely to see a rise in demand for aluminum sheets and foils, which are essential for producing lightweight vehicle parts. This shift not only supports sustainability goals but also enhances the overall performance of vehicles.

Technological Innovations in Manufacturing

Technological advancements in manufacturing processes are significantly impacting the aluminum flat-rolled-products market in APAC. Innovations such as advanced rolling techniques and automation are enhancing production efficiency and product quality. The introduction of smart manufacturing technologies is expected to reduce production costs by up to 15%, thereby making aluminum flat-rolled products more competitive in various applications. Furthermore, these innovations allow for the customization of products to meet specific industry requirements, which is crucial for sectors like aerospace and electronics. As the aluminum flat-rolled-products market adapts to these technological changes, it is likely to experience increased competitiveness and growth opportunities.

Government Initiatives Supporting Aluminum Usage

Government initiatives across APAC are increasingly supporting the use of aluminum in various industries, which is beneficial for the aluminum flat-rolled-products market. Policies aimed at promoting sustainable materials and reducing environmental impact are encouraging manufacturers to adopt aluminum solutions. For instance, several governments are offering incentives for industries that utilize lightweight and recyclable materials, which aligns with the properties of aluminum. This support is expected to boost the aluminum flat-rolled-products market, as companies seek to comply with regulations and enhance their sustainability profiles. The anticipated growth in aluminum usage in construction, automotive, and packaging sectors is likely to further solidify the market's position in the coming years.

Rising Demand from Electrical and Electronics Sector

The electrical and electronics sector in APAC is experiencing robust growth, which is positively influencing the aluminum flat-rolled-products market. With the increasing adoption of aluminum in electrical applications due to its excellent conductivity and lightweight properties, the demand for aluminum flat-rolled products is expected to rise. The market for electrical and electronic equipment is projected to grow at a CAGR of around 6% through 2030, further driving the need for aluminum sheets and foils. This trend is particularly evident in the production of components such as heat sinks, connectors, and enclosures. As a result, the aluminum flat-rolled-products market is likely to see a significant uptick in demand from this sector.