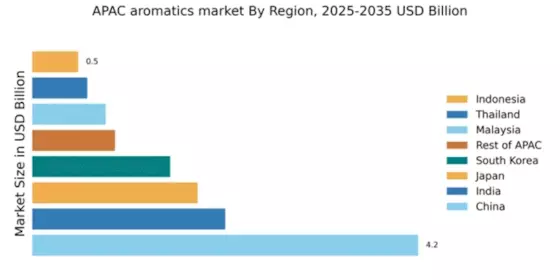

China : Unmatched Growth and Demand Trends

China holds a commanding 4.2% market share in the APAC aromatics sector, driven by rapid industrialization and urbanization. Key growth drivers include increasing demand for petrochemicals in manufacturing and a shift towards sustainable practices. Government initiatives, such as the 14th Five-Year Plan, emphasize green development, while investments in infrastructure bolster production capabilities. The consumption pattern is shifting towards high-value specialty chemicals, reflecting changing consumer preferences.

India : Rapid Growth in Demand and Supply

India's aromatics market accounts for 2.1% of the APAC share, valued at approximately $X billion. The growth is fueled by rising urbanization, increasing disposable incomes, and a burgeoning automotive sector. Regulatory support, including the National Chemical Policy, aims to boost domestic production. The demand for aromatics is also driven by the textile and packaging industries, which are expanding rapidly in response to consumer trends.

Japan : Technological Advancements Drive Growth

Japan holds a 1.8% market share in the aromatics sector, characterized by a strong emphasis on innovation and quality. The market is driven by advanced technologies in chemical production and a focus on high-performance materials. Regulatory frameworks support sustainable practices, encouraging companies to invest in eco-friendly solutions. The demand for aromatics is particularly strong in the automotive and electronics sectors, which are critical to Japan's economy.

South Korea : Key Hub for Aromatics Production

South Korea's aromatics market represents 1.5% of the APAC total, supported by a robust industrial base and significant investments in R&D. The country benefits from government policies that promote innovation and sustainability in chemical production. Major cities like Ulsan and Daesan are key industrial hubs, hosting major players such as LG Chem and SK Global Chemical. The competitive landscape is marked by a focus on high-quality products and export-oriented strategies.

Malaysia : Focus on Sustainable Development

Malaysia's aromatics market accounts for 0.8% of the APAC share, driven by government initiatives aimed at enhancing the petrochemical sector. The Malaysian government has launched the National Petrochemical Policy to attract foreign investment and promote sustainable practices. Demand is growing in the packaging and automotive industries, reflecting broader economic trends. The market is characterized by a mix of local and international players, fostering a competitive environment.

Thailand : Gateway to ASEAN Markets

Thailand's aromatics market holds a 0.6% share in APAC, benefiting from its strategic location and strong trade relationships within ASEAN. The government supports the sector through policies aimed at enhancing production capabilities and attracting foreign investment. Key cities like Map Ta Phut are industrial hubs, hosting major players such as PTT Global Chemical. The market dynamics are influenced by demand from the automotive and consumer goods sectors, driving growth.

Indonesia : Potential for Future Growth

Indonesia's aromatics market represents 0.5% of the APAC total, with significant potential for growth driven by increasing domestic consumption and industrial development. The government is implementing policies to boost the petrochemical sector, including investment incentives. Key markets include Jakarta and Surabaya, where demand is rising in the automotive and construction industries. The competitive landscape is evolving, with both local and international players vying for market share.

Rest of APAC : Varied Growth Across Sub-regions

The Rest of APAC accounts for 0.9% of the aromatics market, encompassing a diverse range of countries with unique growth drivers. Factors such as urbanization, industrialization, and regulatory support vary significantly across these markets. Countries like Vietnam and the Philippines are emerging as key players, driven by increasing demand for consumer goods and infrastructure development. The competitive landscape is characterized by a mix of local and multinational companies, each adapting to regional dynamics.