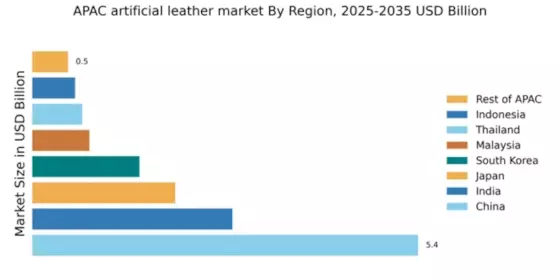

China : Unmatched Growth and Demand Trends

China holds a commanding 5.4% market share in the APAC artificial leather sector, driven by rapid industrialization and urbanization. The demand for artificial leather is surging, particularly in automotive and fashion industries, supported by government initiatives promoting sustainable materials. Regulatory policies favoring eco-friendly production methods are also enhancing market growth, alongside significant investments in infrastructure and manufacturing capabilities.

India : Rapid Growth in Consumption Patterns

India's artificial leather market accounts for 2.8% of the APAC share, reflecting a burgeoning demand driven by the expanding automotive and footwear sectors. The rise in disposable income and changing consumer preferences towards synthetic materials are key growth drivers. Government initiatives aimed at boosting manufacturing and exports further support this trend, alongside a growing focus on sustainability in production processes.

Japan : Quality and Sustainability Focus

Japan's market share stands at 2.0%, characterized by a strong emphasis on quality and innovation in artificial leather production. The demand is primarily driven by the automotive and fashion industries, where high-performance materials are essential. Regulatory frameworks encourage sustainable practices, and government support for R&D in synthetic materials is fostering growth. The market is also witnessing a shift towards eco-friendly alternatives.

South Korea : Competitive Landscape and Innovation

South Korea holds a 1.5% market share in the artificial leather sector, with significant demand from the fashion and automotive industries. The country's focus on innovation and design is driving consumption patterns, supported by government policies promoting sustainable manufacturing. Key players are investing in advanced technologies to enhance product quality and reduce environmental impact, creating a competitive market environment.

Malaysia : Strategic Location for Manufacturing

Malaysia's artificial leather market represents 0.8% of the APAC total, with growth driven by its strategic location and diverse applications in automotive, furniture, and fashion. The government is actively promoting the manufacturing sector through incentives and infrastructure development. Local demand is increasing as consumers shift towards synthetic materials, supported by favorable regulatory policies that encourage sustainable practices.

Thailand : Focus on Eco-Friendly Production

Thailand's market share in artificial leather is 0.7%, with growth fueled by a rising demand for sustainable products in the automotive and fashion sectors. Government initiatives aimed at promoting eco-friendly manufacturing are enhancing market dynamics. The competitive landscape includes both local and international players, with a focus on innovation and quality to meet consumer expectations and regulatory standards.

Indonesia : Potential for Market Expansion

Indonesia accounts for 0.6% of the APAC artificial leather market, with significant potential for growth driven by increasing urbanization and consumer demand. The government is implementing policies to boost local manufacturing and attract foreign investment. Key industries such as automotive and fashion are expanding, creating opportunities for local manufacturers to innovate and compete in the market.

Rest of APAC : Varied Demand Across Sub-Regions

The Rest of APAC holds a 0.5% market share in artificial leather, characterized by diverse markets with varying demand trends. Factors such as economic development, consumer preferences, and regulatory environments differ significantly across countries. Local manufacturers face challenges in competing with established players, but opportunities exist in niche markets focusing on sustainability and innovation in production processes.