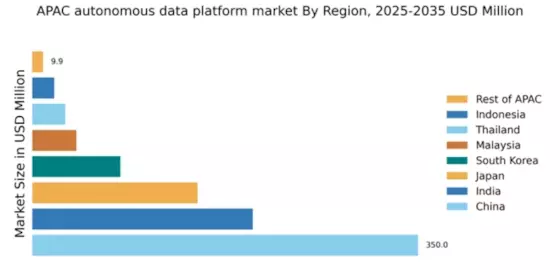

China : Unmatched Growth and Innovation

China holds a commanding market share of 43.5% in the autonomous data-platform sector, valued at $350.0 million. Key growth drivers include rapid digital transformation, government support for AI initiatives, and increasing demand for data analytics across industries. The Chinese government has implemented favorable policies to boost tech innovation, while significant investments in infrastructure, such as 5G networks, are enhancing data accessibility and processing capabilities.

India : Emerging Market with High Demand

Key markets include Bengaluru, Hyderabad, and Pune, which are tech hubs attracting major players like Microsoft and IBM. The competitive landscape is vibrant, with local startups innovating alongside global giants. The business environment is favorable, with a focus on sectors like e-commerce, fintech, and healthcare, driving demand for autonomous data solutions.

Japan : Tech-Driven Market Dynamics

Tokyo and Osaka are key markets, hosting major tech firms and startups. The competitive landscape features significant players like Oracle and SAP, alongside local companies. The business environment is characterized by a focus on manufacturing, automotive, and healthcare sectors, which are increasingly adopting autonomous data solutions.

South Korea : Tech-Savvy Consumer Base

Seoul is the primary market, with a competitive landscape featuring major players like IBM and Google. The business environment is dynamic, with a focus on sectors such as telecommunications, finance, and retail, which are increasingly leveraging data platforms for enhanced decision-making and operational efficiency.

Malaysia : Emerging Market with Potential

Kuala Lumpur and Penang are key markets, with a competitive landscape featuring both local and international players. Major companies like Microsoft and SAP have established a presence, contributing to a vibrant business environment. The focus on sectors such as e-commerce and logistics is driving the adoption of autonomous data solutions.

Thailand : Strategic Growth Opportunities

Bangkok is the primary market, with a competitive landscape featuring both local startups and international players. Companies like Google and AWS are making significant inroads, contributing to a favorable business environment. The focus on sectors such as tourism and retail is driving the demand for innovative data solutions.

Indonesia : Growing Demand for Data Solutions

Jakarta is the key market, with a competitive landscape featuring local startups and international players like Amazon Web Services. The business environment is evolving, with a focus on sectors such as e-commerce and finance, driving the demand for autonomous data solutions.

Rest of APAC : Untapped Markets Awaiting Growth

Key markets include smaller nations like Vietnam and the Philippines, where local players are beginning to innovate. The competitive landscape is diverse, with a mix of local and international companies entering the market. The business environment is characterized by unique sector-specific applications, creating opportunities for growth.