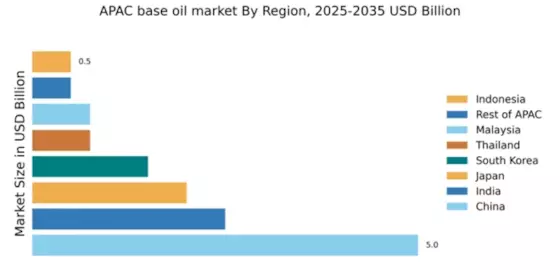

China : Unmatched Growth and Demand Trends

China holds a commanding 5.0% market share in the APAC base oil sector, driven by rapid industrialization and increasing automotive production. The demand for high-quality lubricants is surging, supported by government initiatives promoting energy efficiency and environmental sustainability. Infrastructure development, particularly in urban areas like Shanghai and Beijing, is enhancing distribution networks, further fueling market growth. Regulatory policies are increasingly favoring the adoption of synthetic oils, aligning with global sustainability goals.

India : Rapid Growth in Industrial Demand

India's base oil market accounts for 2.5% of the APAC share, reflecting robust growth driven by the automotive and manufacturing sectors. The increasing demand for high-performance lubricants is supported by government initiatives aimed at enhancing manufacturing capabilities under the 'Make in India' program. The market is characterized by a shift towards synthetic oils, driven by rising consumer awareness and regulatory support for eco-friendly products. Infrastructure improvements in key states like Maharashtra and Gujarat are also pivotal.

Japan : Innovation in Base Oil Production

Japan holds a 2.0% market share in the APAC base oil market, characterized by advanced technology and high-quality production standards. The demand is primarily driven by the automotive sector, with a focus on energy-efficient lubricants. Government policies promoting innovation and sustainability are fostering a competitive landscape. The market is witnessing a gradual shift towards bio-based oils, aligning with global trends towards environmental responsibility. Key cities like Tokyo and Osaka are central to this growth.

South Korea : Key Player in Base Oil Production

South Korea's base oil market represents 1.5% of the APAC total, bolstered by a strong industrial base and significant automotive manufacturing. The demand for high-quality lubricants is increasing, driven by stringent regulations on emissions and energy efficiency. Major players like SK Innovation and GS Caltex dominate the landscape, supported by government initiatives aimed at enhancing production capabilities. Cities such as Ulsan and Busan are critical hubs for base oil production and distribution.

Malaysia : Focus on Sustainable Development

Malaysia's base oil market, accounting for 0.75% of APAC, is on a growth trajectory driven by increasing industrial activities and government support for sustainable practices. The demand for high-performance lubricants is rising, particularly in the automotive and manufacturing sectors. Regulatory frameworks are encouraging the use of eco-friendly products, while infrastructure improvements in states like Selangor and Penang are enhancing market accessibility. Local players are increasingly focusing on innovation to meet evolving consumer needs.

Thailand : Diverse Applications and Growth Potential

Thailand's base oil market also holds a 0.75% share in APAC, driven by a diverse range of applications across automotive and industrial sectors. The government's focus on enhancing manufacturing capabilities and promoting sustainable practices is fostering market growth. Key cities like Bangkok and Chonburi are central to production and distribution. The competitive landscape features both local and international players, with a growing emphasis on high-quality and environmentally friendly lubricants.

Indonesia : Focus on Local Production and Consumption

Indonesia's base oil market, representing 0.5% of APAC, is characterized by significant growth potential driven by increasing automotive sales and industrial activities. The government is promoting local production to reduce dependency on imports, supported by initiatives aimed at enhancing infrastructure. Key cities like Jakarta and Surabaya are pivotal for market dynamics. The competitive landscape includes both local and international players, with a growing emphasis on sustainable and high-performance lubricants.

Rest of APAC : Opportunities Across Multiple Sectors

The Rest of APAC region holds a 0.5% market share in the base oil sector, characterized by diverse markets with varying growth dynamics. Countries like Vietnam and the Philippines are witnessing increasing demand for lubricants driven by industrial growth and automotive expansion. Government initiatives aimed at enhancing manufacturing capabilities are pivotal. The competitive landscape features a mix of local and international players, with a focus on sustainable practices and high-quality products.