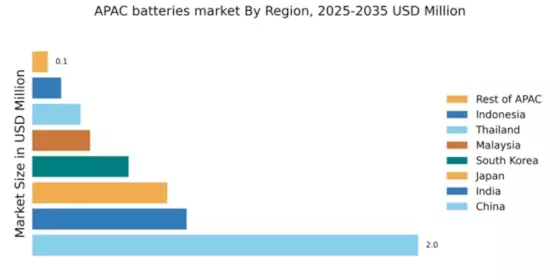

China : Unmatched Growth and Innovation

Key markets include Shanghai, Beijing, and Shenzhen, where major players like CATL and BYD dominate. The competitive landscape is characterized by aggressive R&D investments and partnerships with automotive companies. Local dynamics favor large-scale production and innovation, particularly in lithium-ion batteries for EVs and energy storage systems. The growing demand for consumer electronics further fuels market expansion.

India : Rapid Growth in EV Adoption

Key markets include Delhi, Maharashtra, and Karnataka, where companies like A123 Systems and local startups are making strides. The competitive landscape is evolving, with both domestic and international players vying for market share. The business environment is increasingly favorable, with investments in battery technology and manufacturing capabilities. The renewable energy sector, particularly solar, is also a significant driver for battery applications.

Japan : Technological Leadership in Batteries

Key markets include Tokyo and Osaka, where technological advancements are rapidly adopted. The competitive landscape is dominated by established firms, but new entrants are emerging with innovative solutions. The business environment is robust, supported by strong intellectual property protections and collaboration between industry and academia. Applications in automotive and renewable energy sectors are expanding, further driving market growth.

South Korea : Strong Manufacturing and R&D Focus

Key markets include Seoul and Incheon, where major manufacturers are located. The competitive landscape is intense, with a focus on innovation and sustainability. Local dynamics favor large-scale production and partnerships with automotive giants. The business environment is conducive to growth, with strong support for R&D initiatives and a focus on high-capacity batteries for various applications.

Malaysia : Strategic Location for Manufacturing

Key markets include Selangor and Penang, where several battery manufacturers are establishing operations. The competitive landscape is evolving, with both established companies and startups entering the market. The business environment is favorable, supported by government incentives and a growing focus on sustainability. Applications in automotive and energy storage sectors are gaining traction, further boosting market potential.

Thailand : Government Support and Investment

Key markets include Bangkok and Chonburi, where major automotive manufacturers are establishing battery production facilities. The competitive landscape features both local and international players, with a focus on innovation and sustainability. The business environment is improving, supported by favorable regulations and investment incentives. The automotive sector is a primary driver for battery applications, particularly in electric vehicles.

Indonesia : Focus on Sustainable Development

Key markets include Jakarta and West Java, where local and international companies are exploring opportunities. The competitive landscape is developing, with a mix of established firms and new entrants. The business environment is gradually improving, supported by government policies aimed at fostering innovation and investment. Applications in renewable energy and electric vehicles are expected to drive future growth.

Rest of APAC : Varied Growth Across Regions

Key markets include Vietnam and the Philippines, where local manufacturers are beginning to emerge. The competitive landscape is fragmented, with a mix of local and international players. The business environment varies significantly, influenced by regulatory frameworks and market maturity. Applications in consumer electronics and renewable energy are gaining traction, contributing to overall market growth.