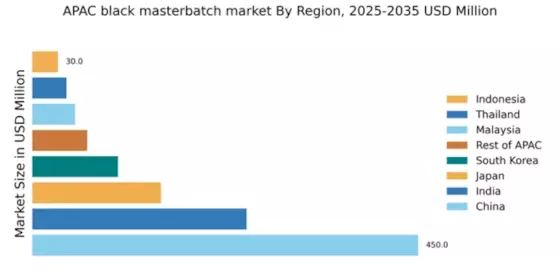

China : Unmatched Growth and Demand Trends

China holds a commanding market share of 450.0, representing a significant portion of the APAC black masterbatch market. Key growth drivers include rapid industrialization, increasing demand from the automotive and packaging sectors, and government initiatives promoting sustainable materials. The country’s robust infrastructure development and favorable regulatory policies further enhance market potential, with a growing emphasis on eco-friendly production processes.

India : Rapid Growth in Industrial Applications

India's black masterbatch market is valued at 250.0, showcasing a growing demand driven by the booming packaging and automotive industries. The government's push for 'Make in India' initiatives and investments in manufacturing infrastructure are pivotal in shaping market dynamics. Additionally, rising consumer awareness regarding product quality and sustainability is influencing consumption patterns, leading to increased demand for high-performance masterbatches.

Japan : Innovation and Quality Drive Demand

Japan's black masterbatch market, valued at 150.0, is characterized by its focus on high-quality and technologically advanced products. The automotive and electronics sectors are primary consumers, with stringent quality standards driving demand for premium masterbatches. Government regulations promoting environmental sustainability and innovation in manufacturing processes are key growth factors, alongside a well-established infrastructure supporting industrial activities.

South Korea : Key Player in Advanced Manufacturing

South Korea's black masterbatch market is valued at 100.0, supported by a strong industrial base and high demand from the electronics and automotive sectors. The government's focus on innovation and technology, coupled with investments in R&D, drives market growth. Local manufacturers are increasingly adopting sustainable practices, aligning with global trends, while cities like Seoul and Busan serve as key market hubs for distribution and consumption.

Malaysia : Strategic Location for Manufacturing

Malaysia's black masterbatch market, valued at 50.0, is witnessing growth due to its strategic location and increasing demand from the packaging and construction sectors. Government initiatives aimed at enhancing manufacturing capabilities and attracting foreign investments are pivotal. The local market is characterized by a mix of domestic and international players, with a focus on sustainable production methods and compliance with environmental regulations.

Thailand : Focus on Eco-Friendly Solutions

Thailand's black masterbatch market, valued at 40.0, is evolving with a growing emphasis on sustainable practices. The packaging and automotive industries are significant contributors to demand, driven by consumer preferences for eco-friendly products. Government policies promoting green manufacturing and investments in infrastructure are key growth drivers. Major cities like Bangkok are central to market activities, fostering a competitive landscape among local and international players.

Indonesia : Potential for Growth in Various Sectors

Indonesia's black masterbatch market, valued at 30.0, is emerging with diverse applications across packaging, automotive, and construction sectors. The growing middle class and urbanization are driving demand for quality products. Government initiatives aimed at boosting manufacturing and reducing import dependency are crucial for market growth. Key cities like Jakarta and Surabaya are vital for distribution, with local players increasingly competing with international brands.

Rest of APAC : Varied Demand Across Sub-Regions

The Rest of APAC market for black masterbatch, valued at 64.0, encompasses a variety of countries with distinct market characteristics. Demand is driven by local industries such as packaging, textiles, and automotive. Each country has unique regulatory environments and consumption patterns, influenced by local economic conditions. The competitive landscape features both regional and global players, adapting to the specific needs of each market.