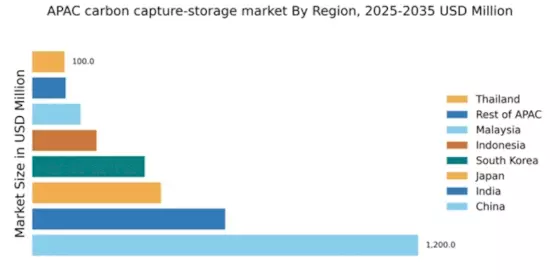

China : China's Dominance in Carbon Solutions

Key markets include major industrial hubs like Beijing, Shanghai, and Guangdong Province. The competitive landscape features significant players such as ExxonMobil, Shell, and TotalEnergies, all vying for market share. Local dynamics are influenced by a robust manufacturing sector and increasing public awareness of climate change. The energy sector is a primary application area, with coal-fired power plants being a focal point for carbon capture technologies. The business environment is favorable, supported by government incentives and a growing emphasis on sustainability.

India : India's Growing Carbon Capture Landscape

Key markets include Maharashtra, Gujarat, and Tamil Nadu, where industrial activities are concentrated. The competitive landscape features players like BP and Aker Solutions, who are establishing partnerships with local firms. The business environment is evolving, with increasing collaboration between government and private sectors. The cement and steel industries are primary sectors for carbon capture applications, reflecting India's commitment to reducing its carbon footprint.

Japan : Japan's Technological Advancements in CCS

Key markets include Tokyo, Osaka, and Aichi Prefecture, where industrial activities are concentrated. Major players like Mitsubishi Heavy Industries and Shell are actively involved in the market, focusing on innovative solutions. The competitive landscape is characterized by collaboration between public and private sectors, enhancing the business environment. The energy and manufacturing sectors are primary applications for carbon capture technologies, reflecting Japan's focus on sustainability and innovation.

South Korea : South Korea's Commitment to Sustainability

Key markets include Seoul, Ulsan, and Incheon, where industrial activities are concentrated. Major players like Samsung Engineering and Chevron are establishing a strong presence in the market. The competitive landscape is evolving, with increasing collaboration between government and private sectors. The energy and manufacturing sectors are primary applications for carbon capture technologies, reflecting South Korea's commitment to achieving carbon neutrality by 2050.

Malaysia : Malaysia's Emerging Carbon Capture Market

Key markets include Kuala Lumpur, Johor, and Sarawak, where industrial activities are concentrated. The competitive landscape features players like Siemens and Carbon Clean Solutions, who are exploring partnerships with local firms. The business environment is evolving, with increasing government support for carbon capture initiatives. The oil and gas sector is a primary application area, reflecting Malaysia's commitment to reducing its carbon footprint and enhancing sustainability.

Thailand : Thailand's Carbon Capture Initiatives

Key markets include Bangkok, Chonburi, and Rayong, where industrial activities are concentrated. The competitive landscape features players like TotalEnergies and Aker Solutions, who are establishing partnerships with local firms. The business environment is evolving, with increasing collaboration between government and private sectors. The power generation and manufacturing sectors are primary applications for carbon capture technologies, reflecting Thailand's commitment to reducing its carbon footprint.

Indonesia : Indonesia's Growing Carbon Capture Market

Key markets include Jakarta, West Java, and East Kalimantan, where industrial activities are concentrated. The competitive landscape features players like BP and Equinor, who are establishing partnerships with local firms. The business environment is evolving, with increasing collaboration between government and private sectors. The energy sector is a primary application area, reflecting Indonesia's commitment to reducing its carbon footprint and enhancing sustainability.

Rest of APAC : Emerging Markets in Carbon Solutions

Key markets include Vietnam, Philippines, and Singapore, where industrial activities are concentrated. The competitive landscape features emerging players and local firms exploring carbon capture solutions. The business environment is evolving, with increasing government support for carbon capture initiatives. The manufacturing and energy sectors are primary applications for carbon capture technologies, reflecting the commitment of these countries to reducing their carbon footprint and enhancing sustainability.