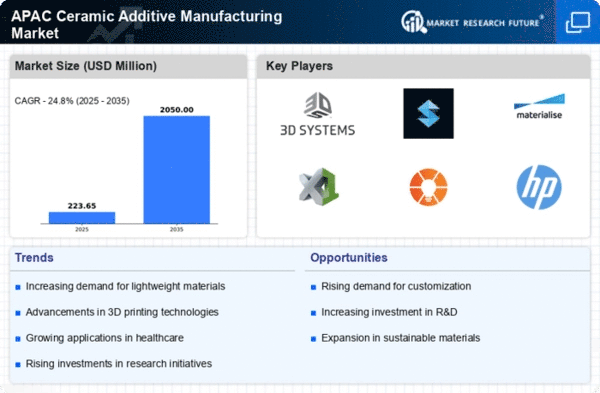

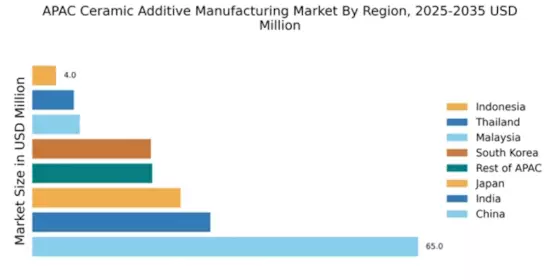

China : Unmatched Growth and Innovation

China holds a commanding 65.0% market share in the ceramic additive manufacturing sector, valued at approximately $1.5 billion. Key growth drivers include rapid industrialization, increased investment in R&D, and a strong push towards automation. Demand trends show a rising interest in customized solutions, supported by government initiatives promoting advanced manufacturing technologies. Infrastructure development, particularly in cities like Shenzhen and Shanghai, further bolsters this growth.

India : Rapid Growth and Investment Opportunities

India captures a 30.0% market share in the ceramic additive manufacturing market, valued at around $700 million. The growth is driven by increasing demand from sectors like aerospace and healthcare, alongside government initiatives like 'Make in India' that encourage local manufacturing. The consumption pattern is shifting towards high-quality, customized products, supported by a burgeoning startup ecosystem in cities like Bengaluru and Pune.

Japan : Precision and Quality at Forefront

Japan holds a 25.0% market share in the ceramic additive manufacturing sector, valued at approximately $600 million. The market is driven by a strong focus on precision engineering and high-quality standards, particularly in automotive and electronics industries. Government policies promoting innovation and sustainability are also key growth factors. The demand for advanced materials is rising, especially in regions like Tokyo and Osaka, where industrial clusters thrive.

South Korea : Strong Industrial Base and R&D Focus

South Korea accounts for a 20.0% market share in the ceramic additive manufacturing market, valued at about $500 million. The growth is fueled by a robust industrial base and significant investments in R&D, particularly in the electronics and automotive sectors. The government supports innovation through various funding programs. Key markets include Seoul and Busan, where major players like Samsung and LG are actively involved in additive manufacturing.

Malaysia : Growing Market with Government Support

Malaysia holds an 8.0% market share in the ceramic additive manufacturing sector, valued at approximately $200 million. The market is driven by government initiatives aimed at positioning Malaysia as a regional manufacturing hub. Demand is growing in sectors like automotive and consumer goods, with a focus on sustainability. Key cities like Kuala Lumpur and Penang are emerging as centers for innovation and investment in additive technologies.

Thailand : Diverse Applications and Growth Potential

Thailand captures a 7.0% market share in the ceramic additive manufacturing market, valued at around $150 million. The growth is driven by increasing applications in automotive and healthcare sectors, supported by government policies promoting technology adoption. The demand for customized solutions is on the rise, particularly in Bangkok and Chonburi, where industrial activities are concentrated. Local players are increasingly collaborating with international firms to enhance capabilities.

Indonesia : Growth Driven by Local Demand

Indonesia holds a 4.0% market share in the ceramic additive manufacturing sector, valued at approximately $100 million. The market is characterized by a growing demand for customized products in sectors like construction and consumer goods. Government initiatives aimed at boosting local manufacturing are also contributing to growth. Key markets include Jakarta and Surabaya, where local startups are beginning to explore additive manufacturing technologies.

Rest of APAC : Varied Growth Across Sub-Regions

The Rest of APAC accounts for a 20.21% market share in the ceramic additive manufacturing sector, valued at around $500 million. This diverse region includes emerging markets with unique growth drivers, such as local demand for customized solutions and government support for innovation. Countries like Vietnam and the Philippines are witnessing increased investments in manufacturing technologies. The competitive landscape is evolving, with both local and international players vying for market share.